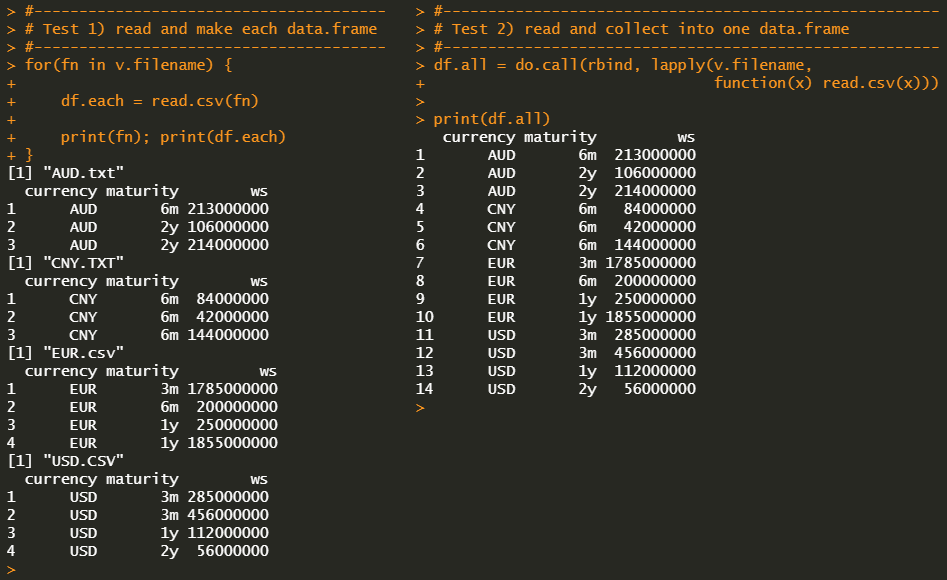

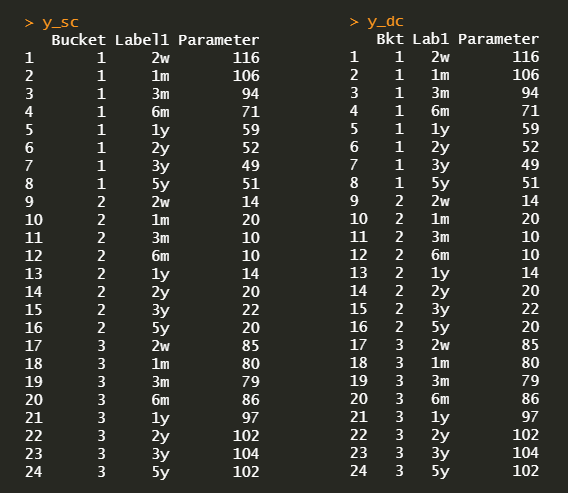

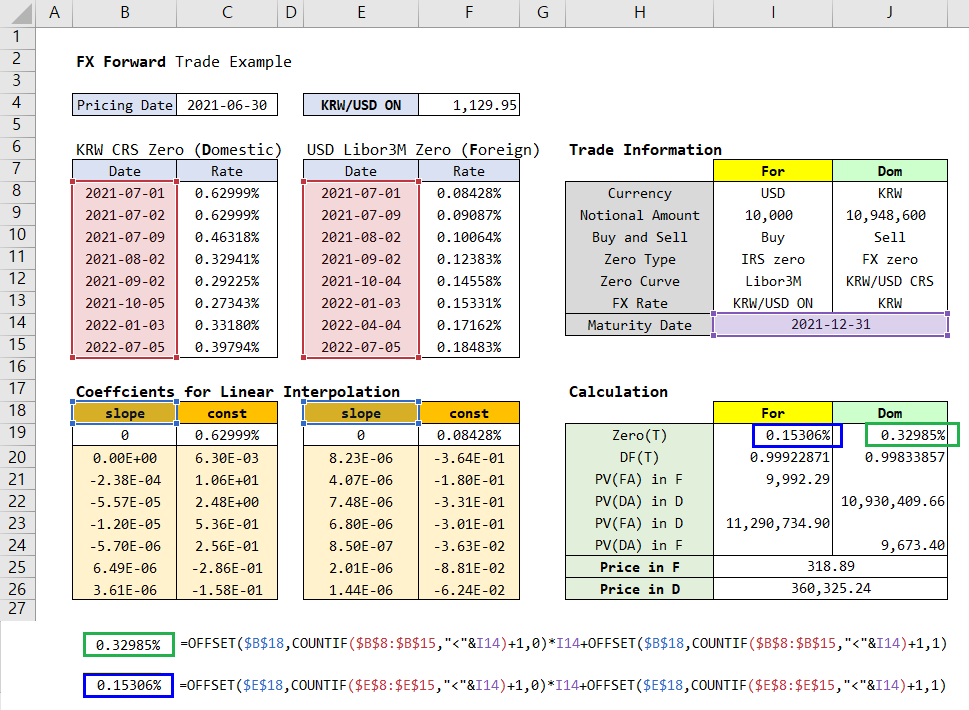

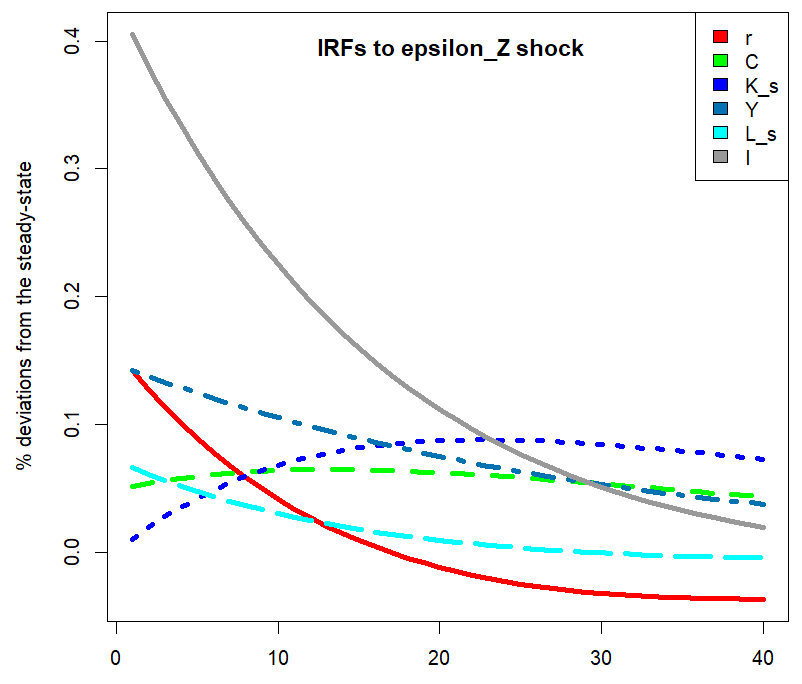

Adams and Deventer Maximum Smoothness Forward Rate Curve using R code

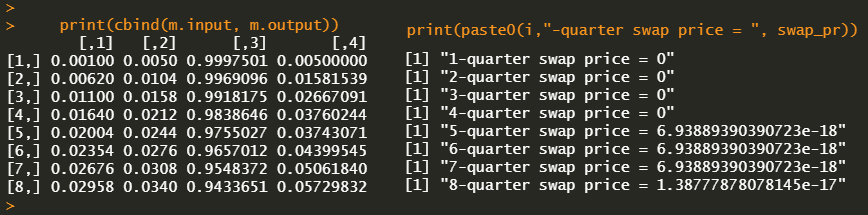

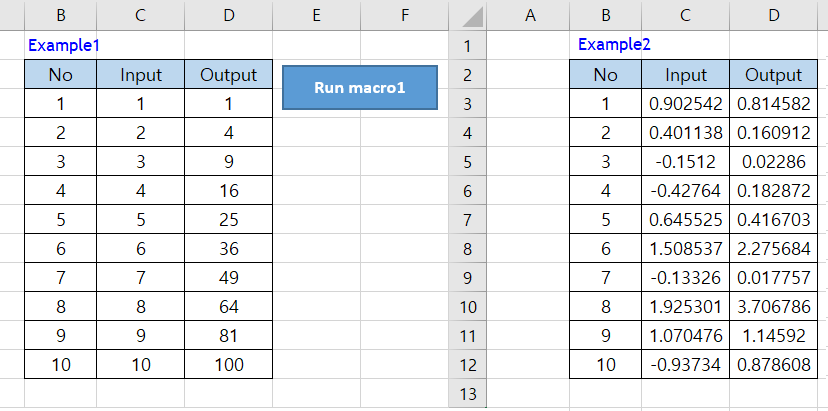

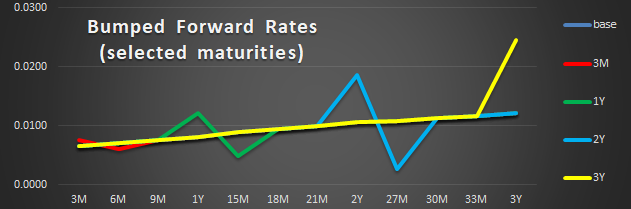

This post implements Adams and Deventer (1994) approach which generates the best fitting yield curve smoothing with the principle of maximum smoothness forward rate curve. This provides a powerful closed-form solution by which we can sidestep a kink...