Using Java functions from JAR file in R using rJava

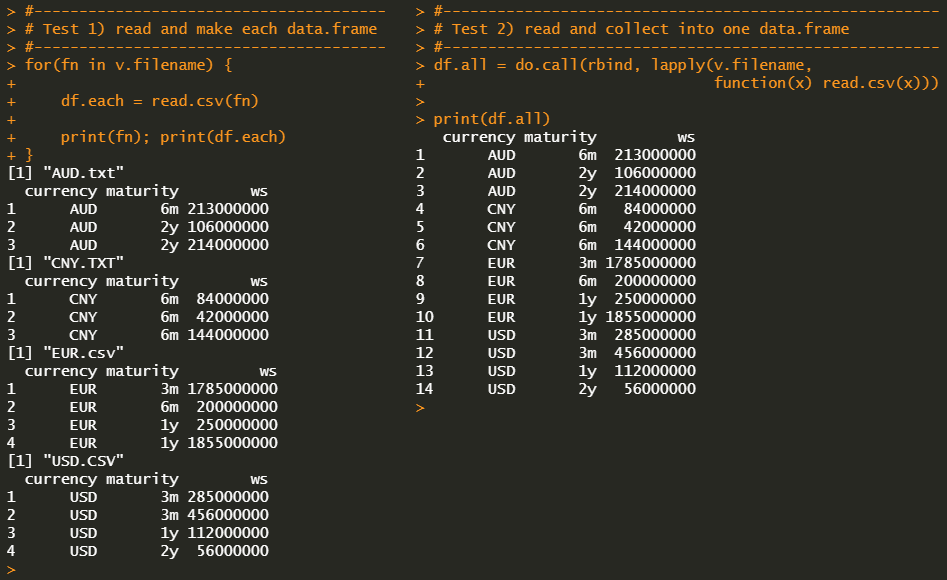

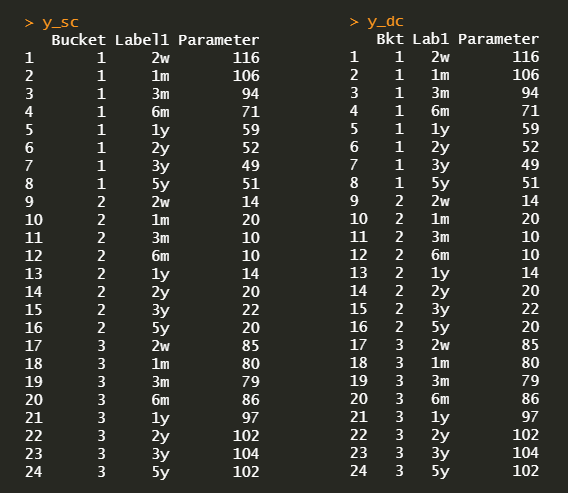

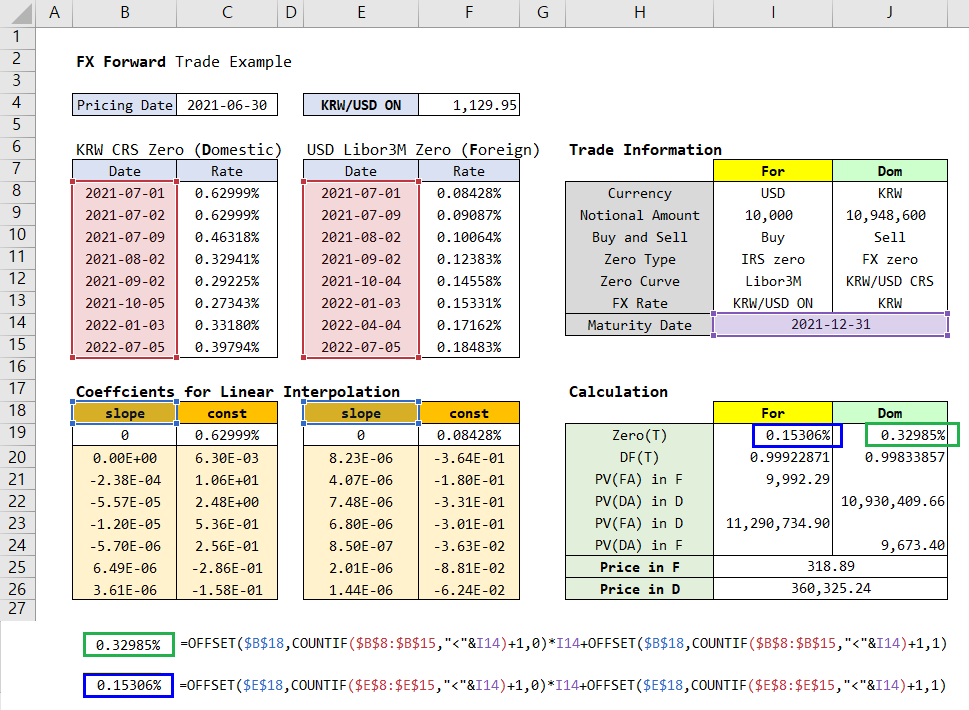

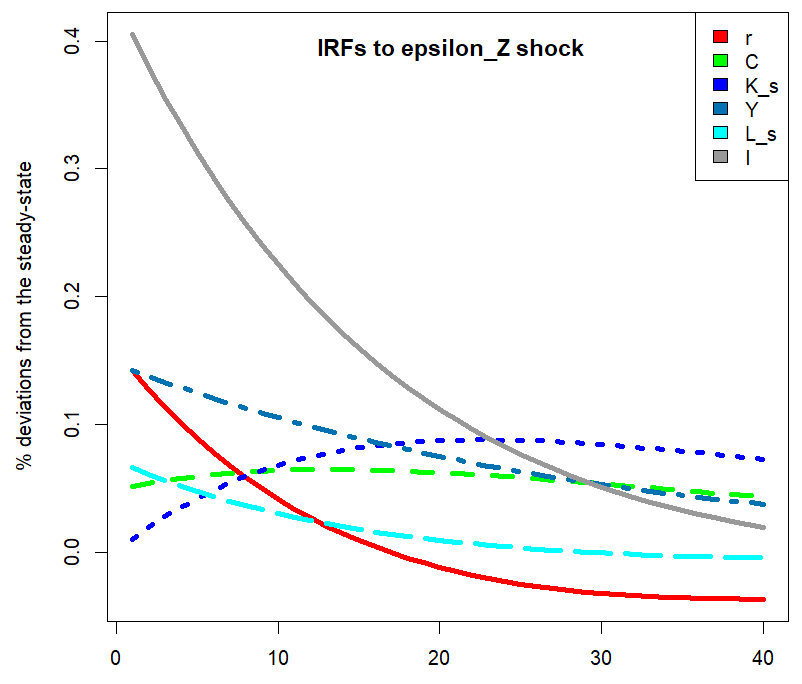

This post explains how to call Java functions from jar file in R. This is useful especially when derivatives pricing or risk calculation engine already have been developed well in the form of Java in your company. It is more efficient to use time-te...