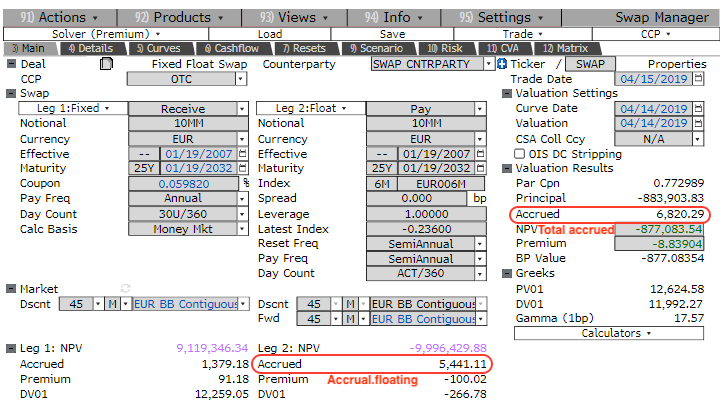

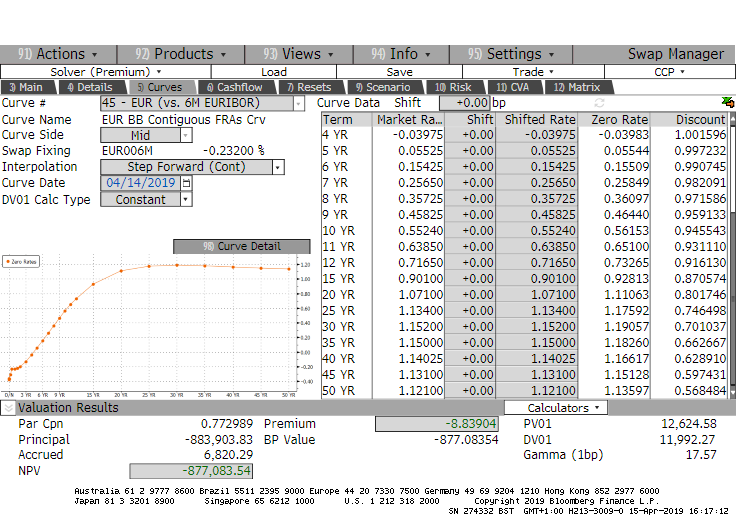

Multi Currency Swap Pricing with SwapPricer

I have released a new version of the package SwapPricer on GitHub

here.

As we are now at version 1.0.1 the toolbox is able to price using just a

one-curve framework but is able to price multiple currencies (ie. CHF, EUR, GBP,

JPY and USD) and any convention in terms of ... [Read more...]