Rebalancing ruminations

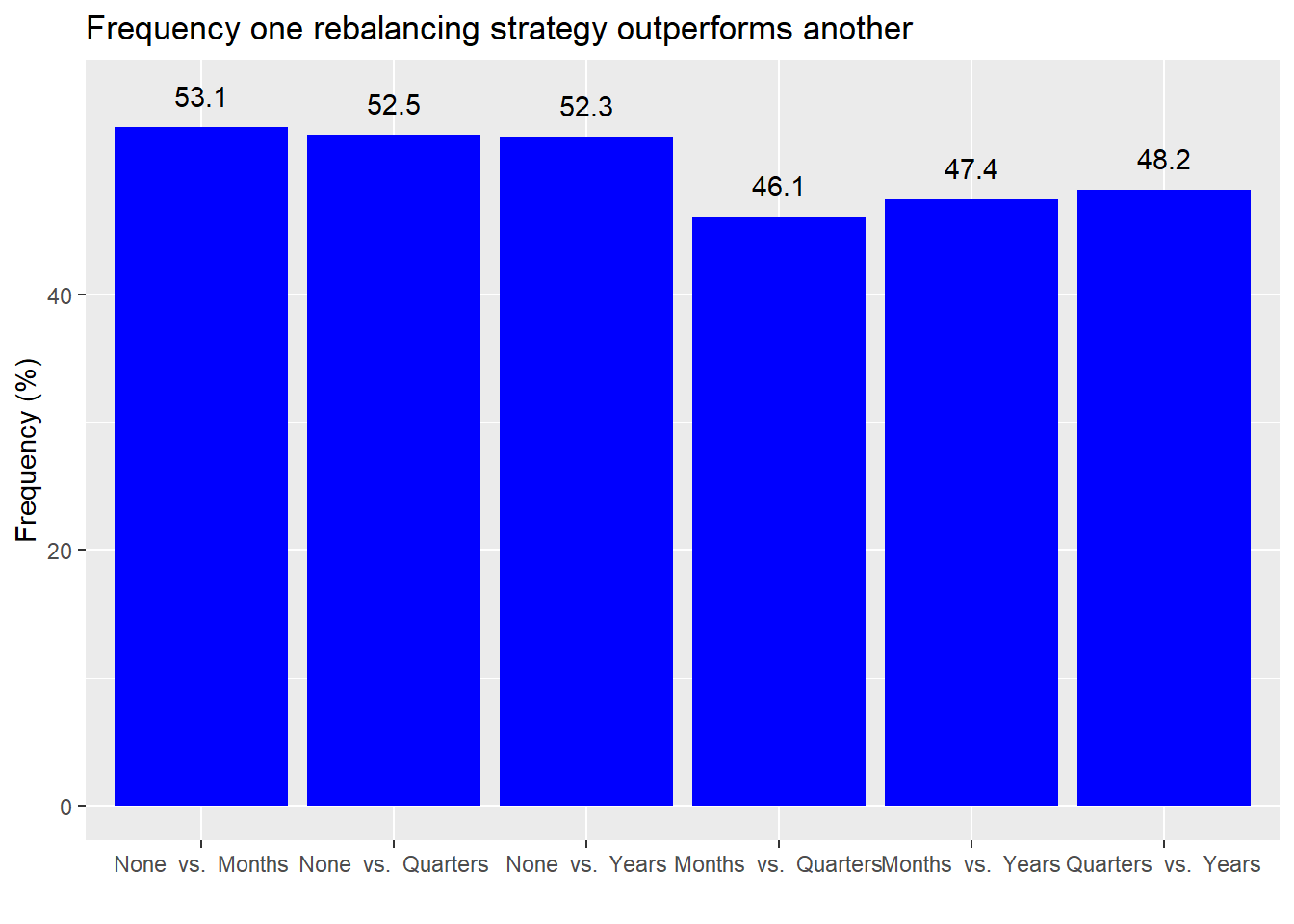

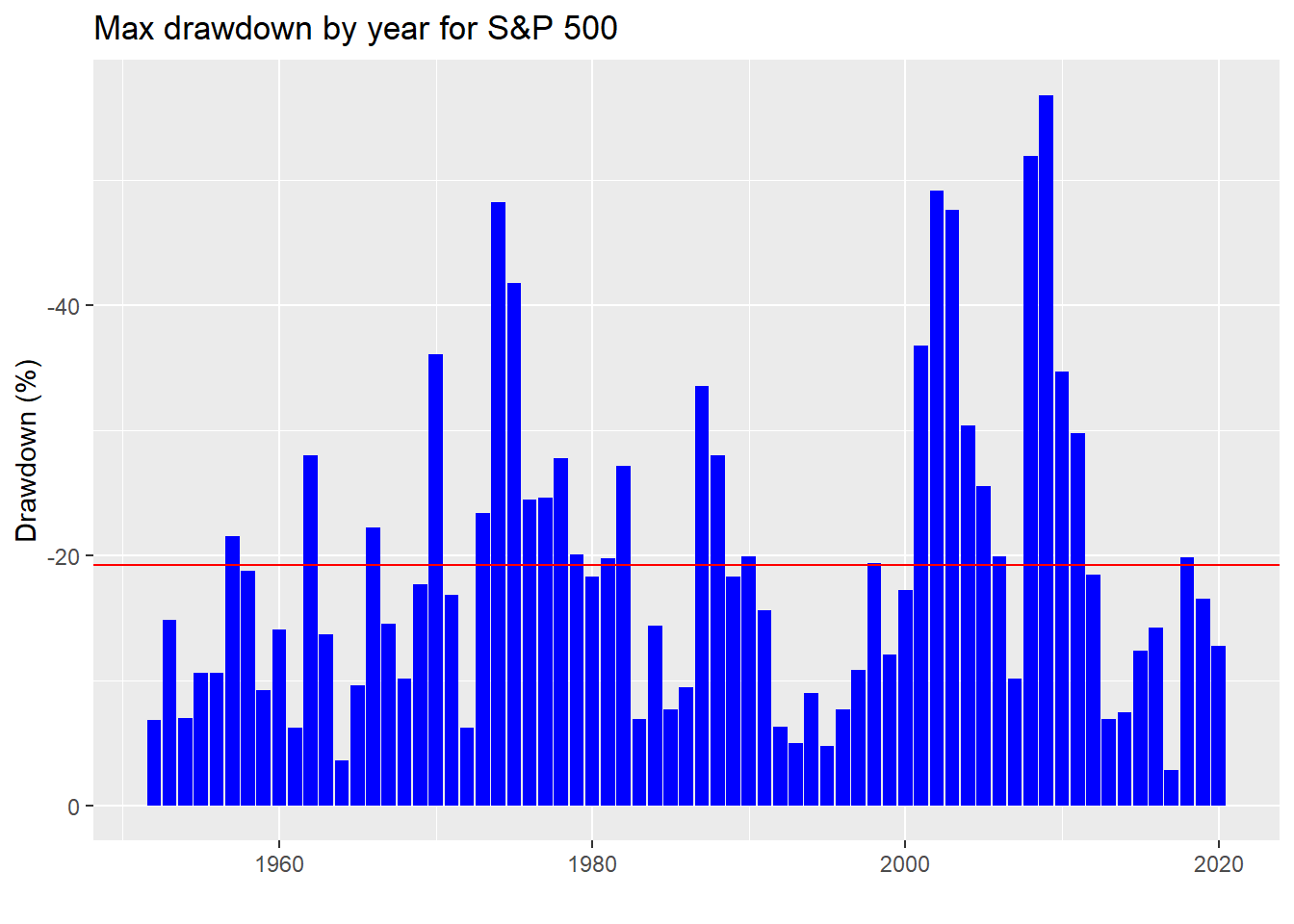

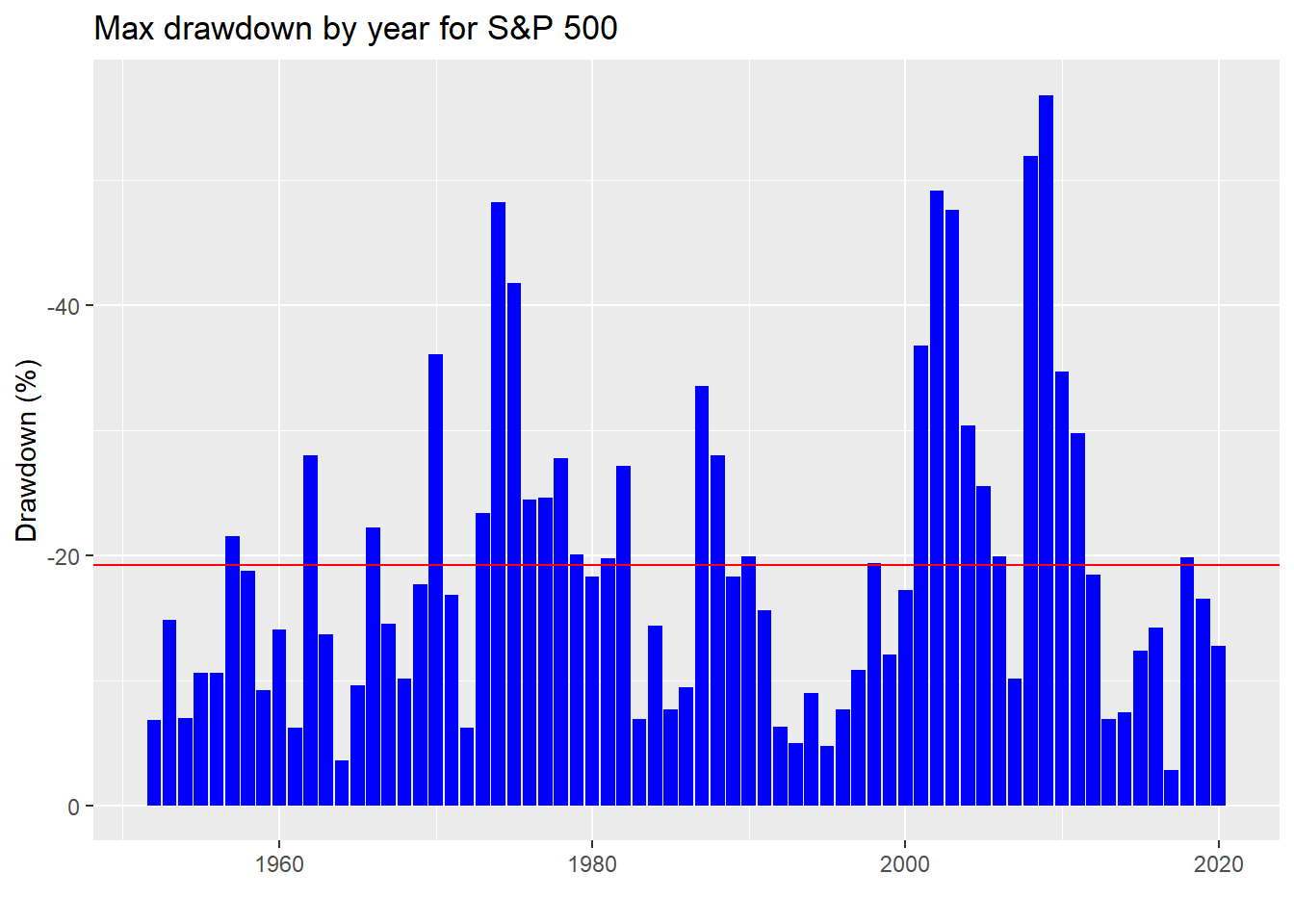

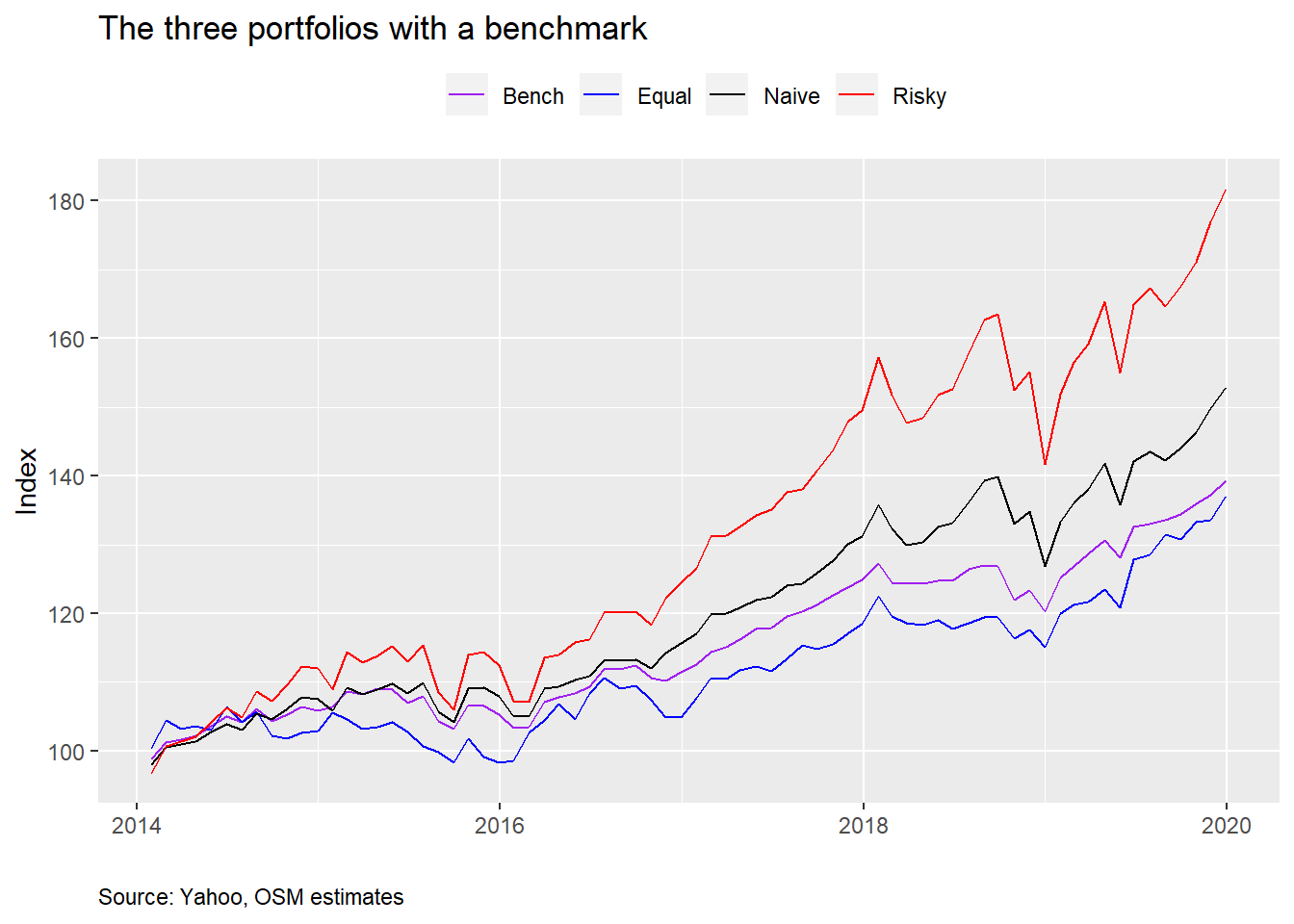

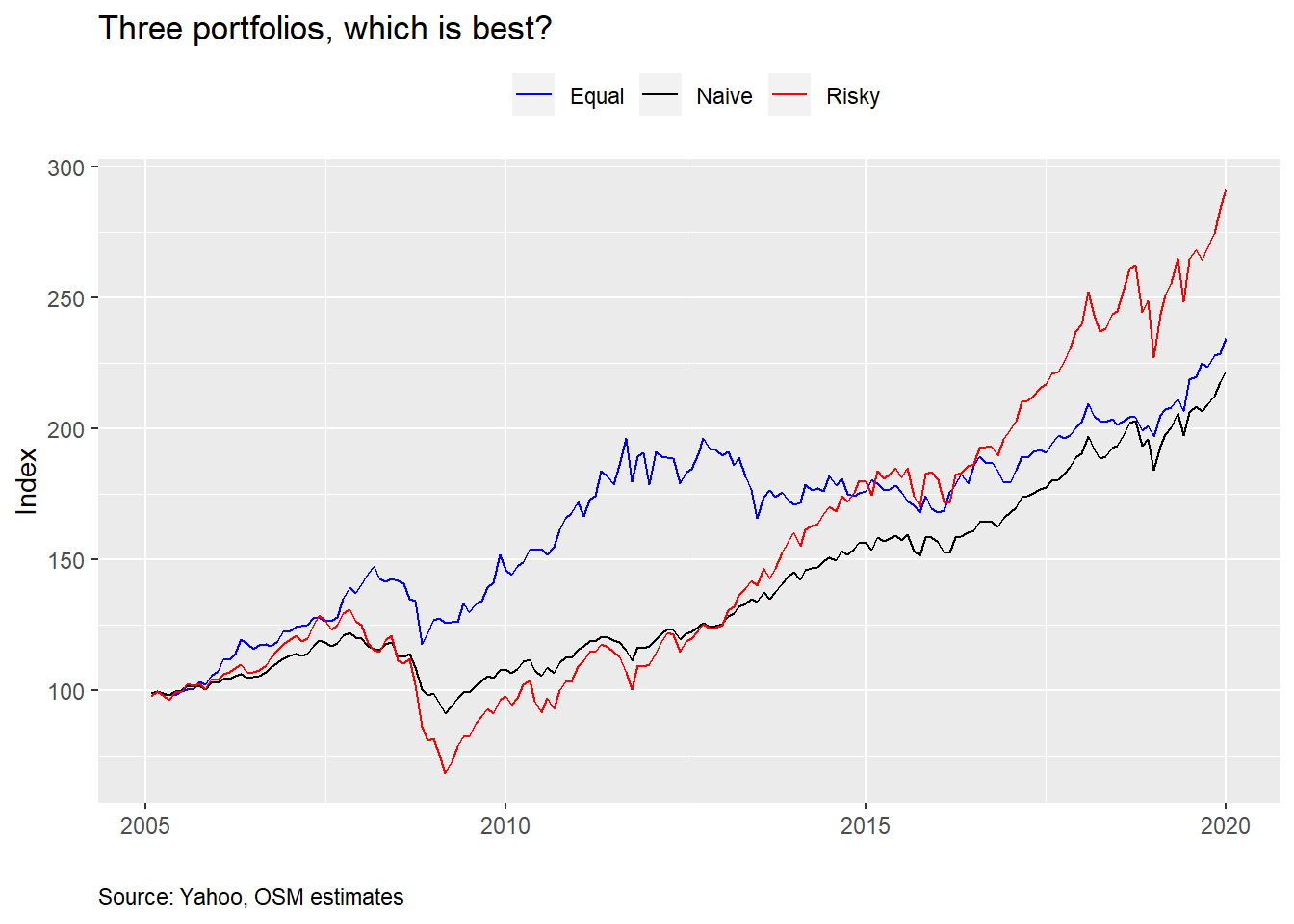

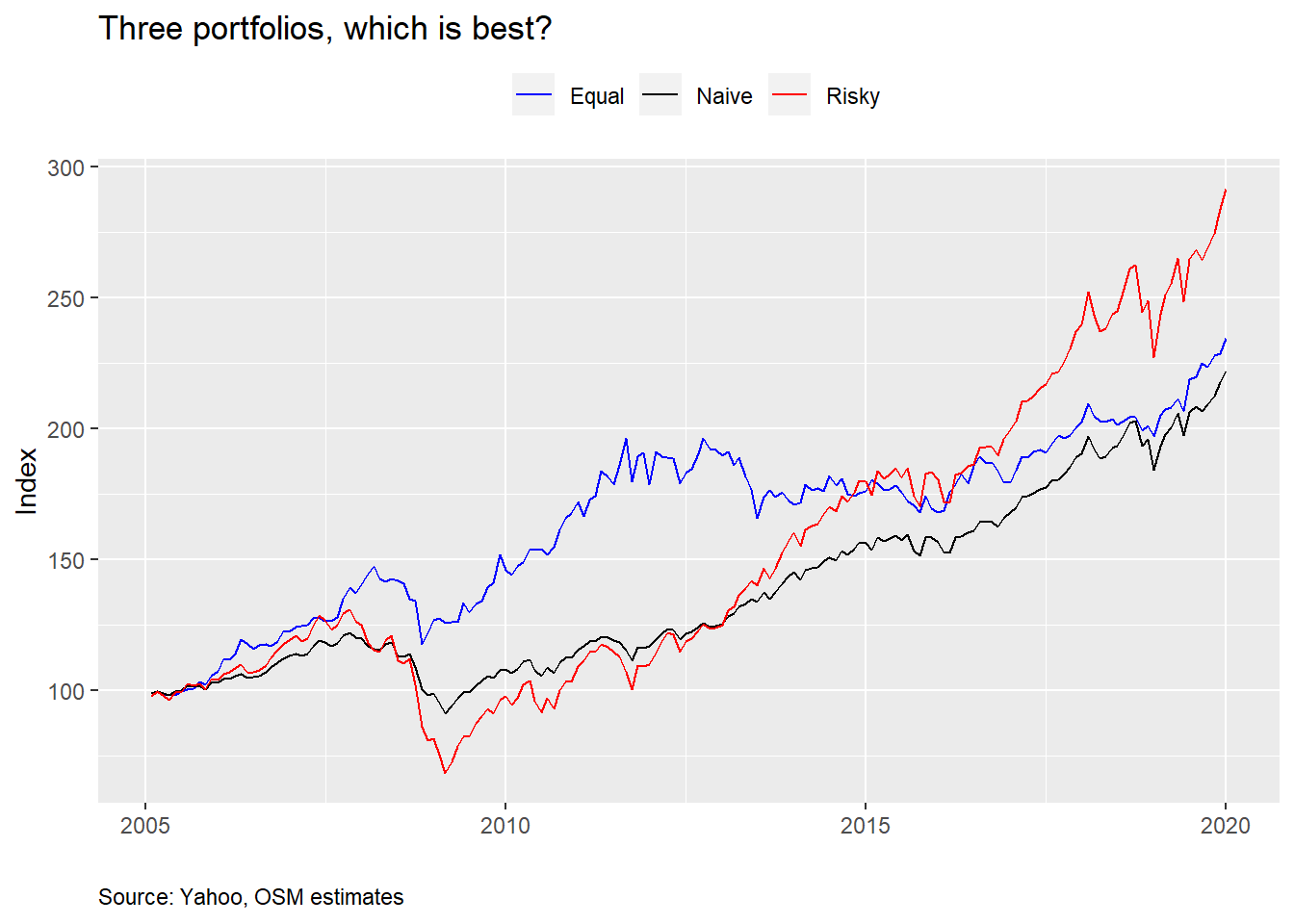

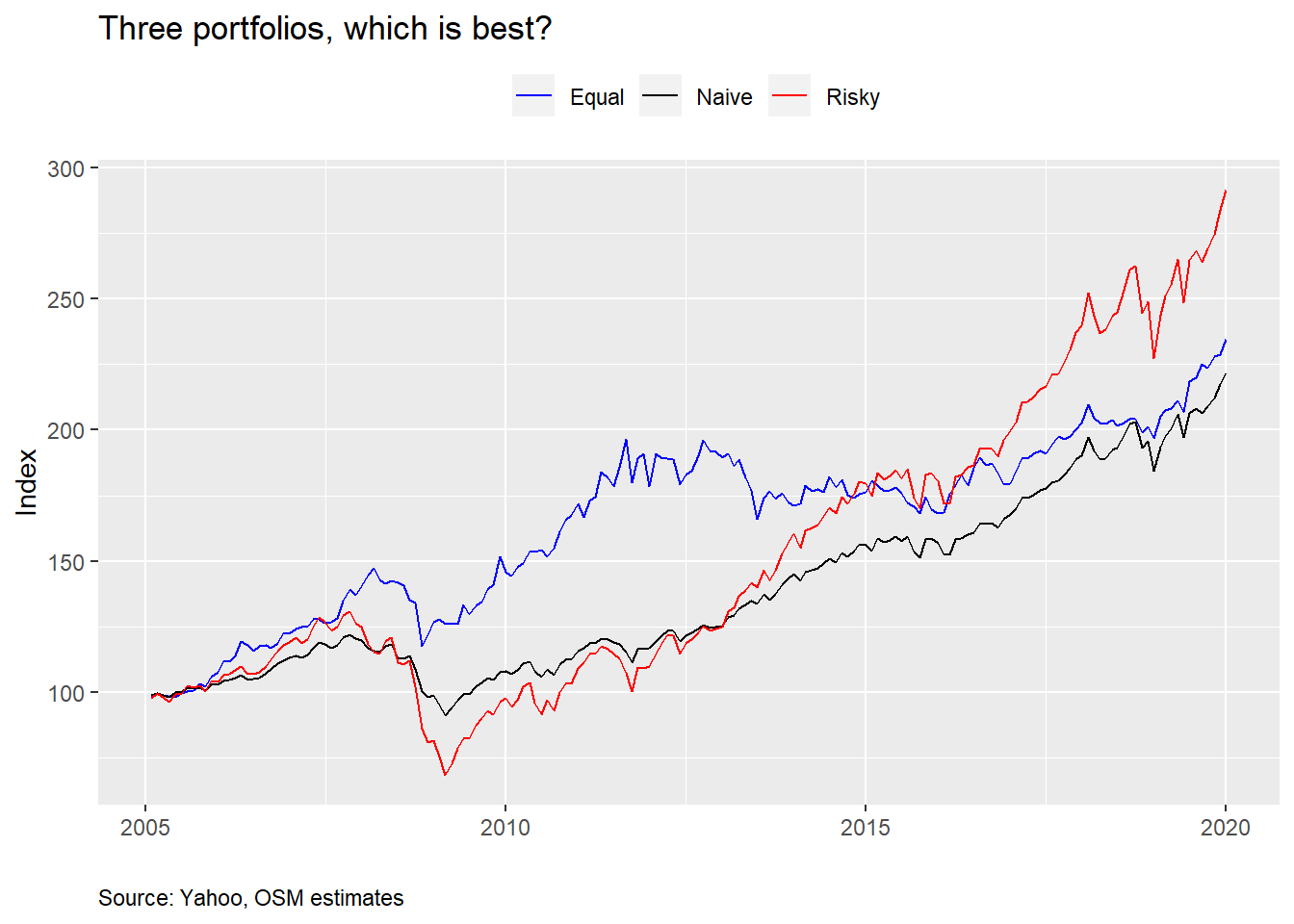

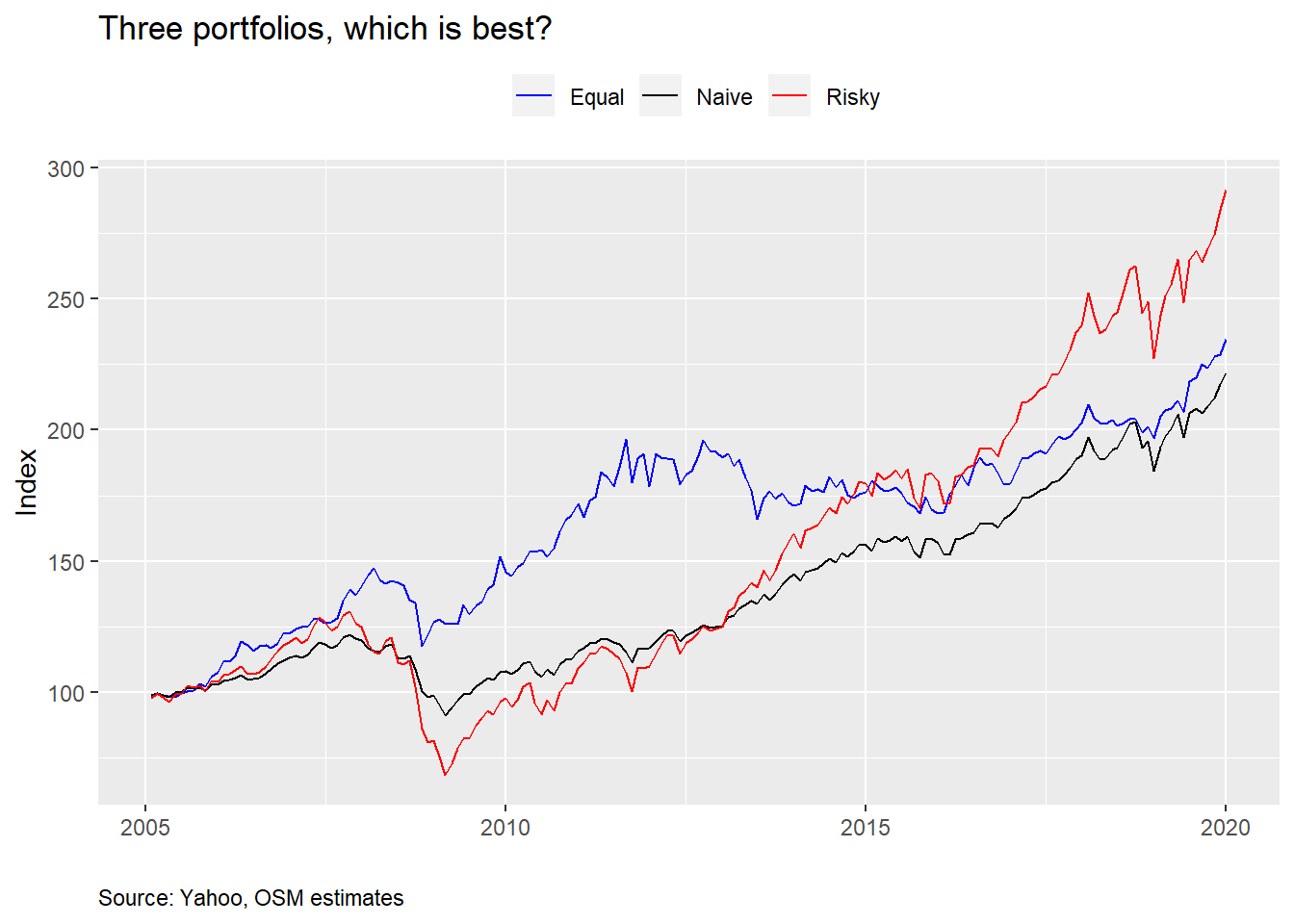

Back in the rebalancing saddle! In our last post on rebalancing, we analyzed whether rebalancing over different periods would have any effect on mean or risk-adjusted returns for our three (equal, naive, and risky) portfolios. We found little eviden...