Performance anxiety

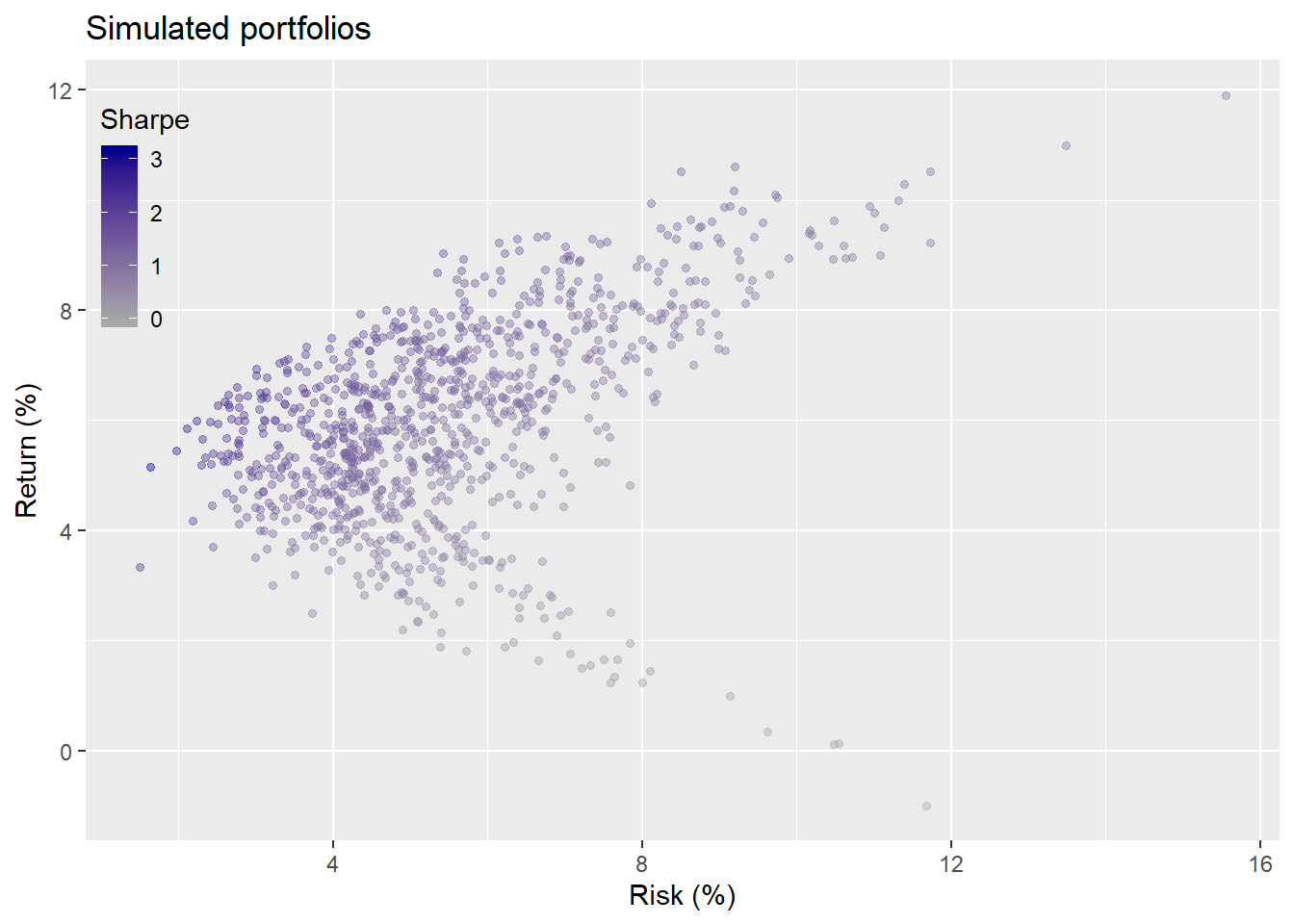

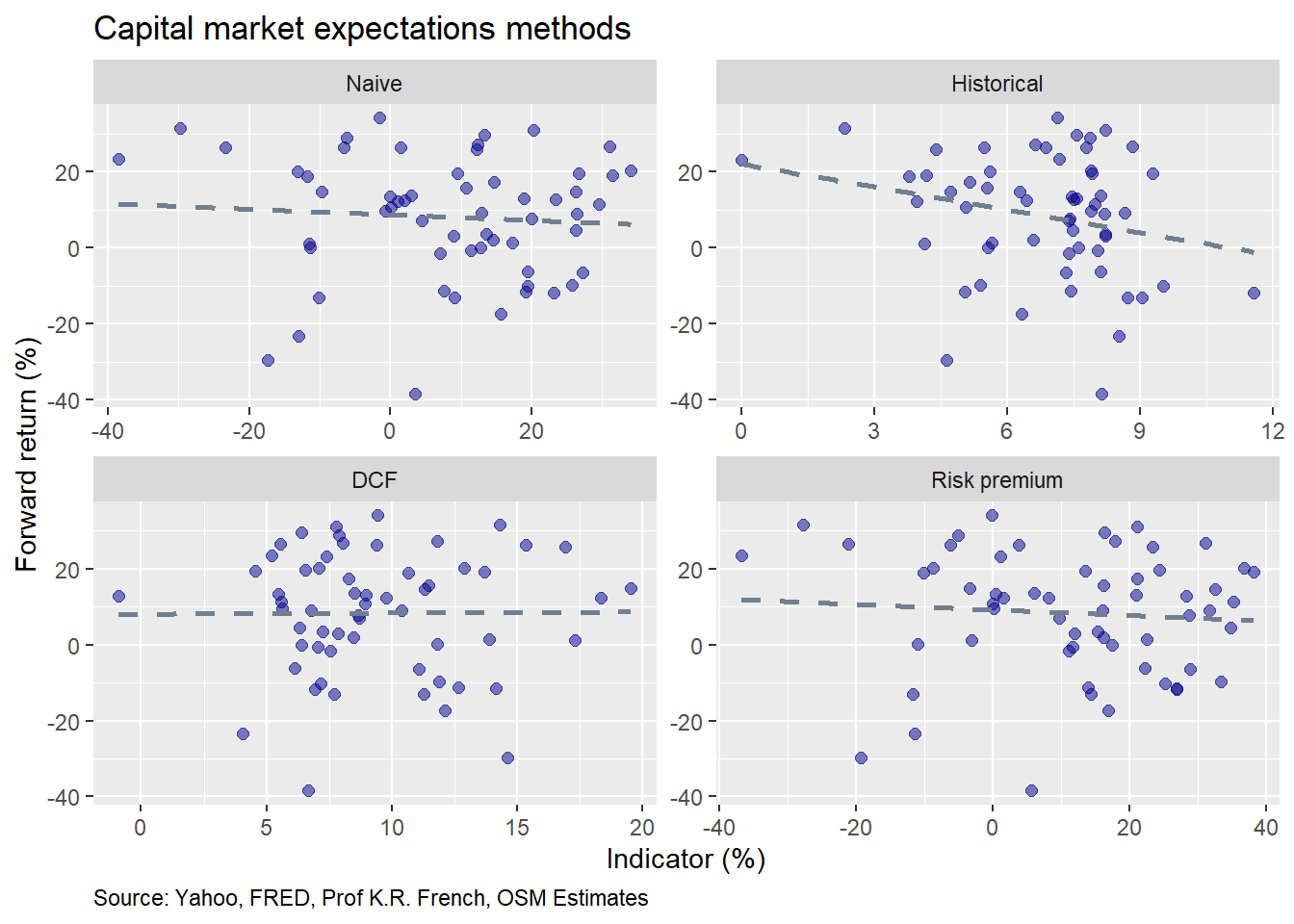

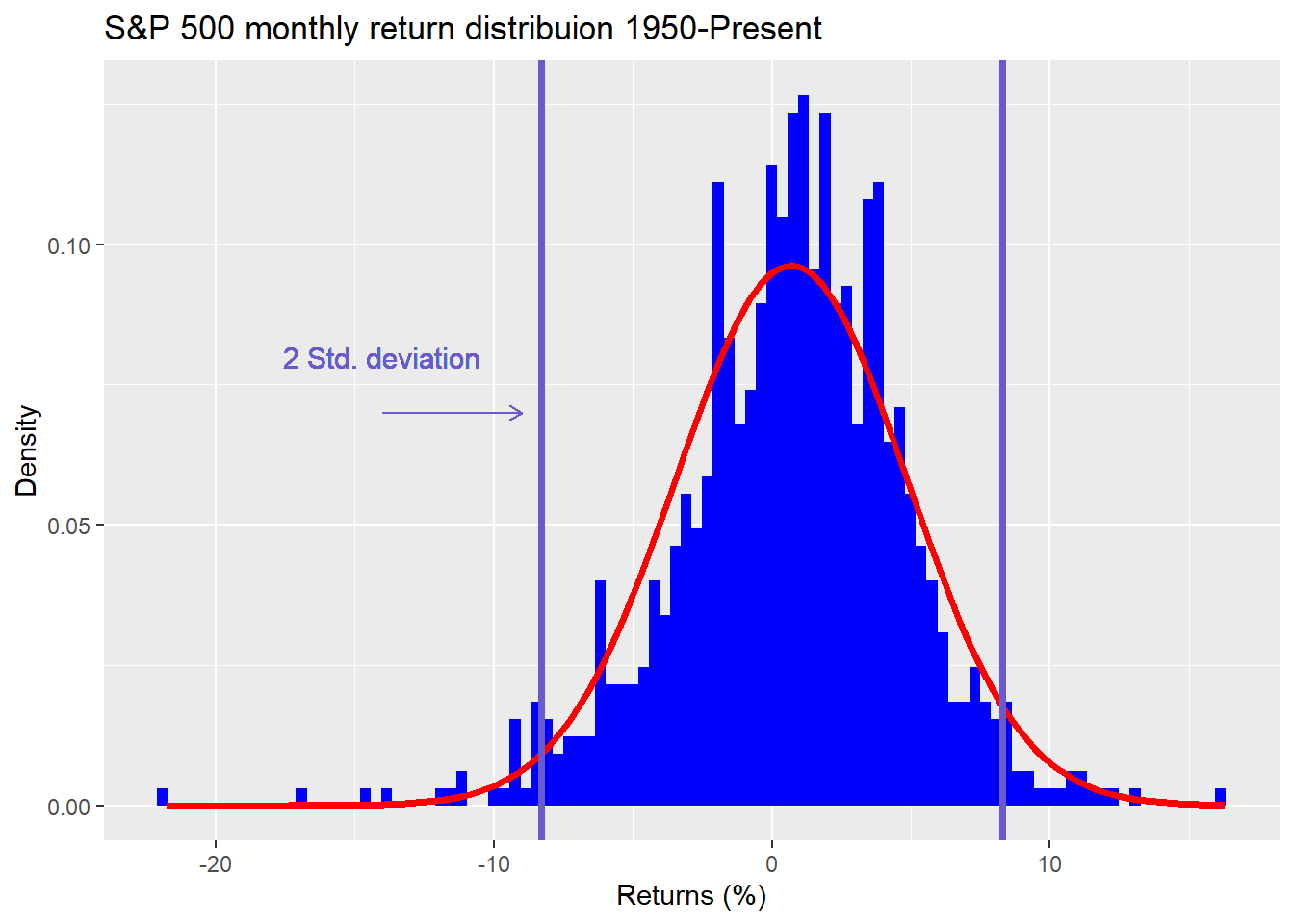

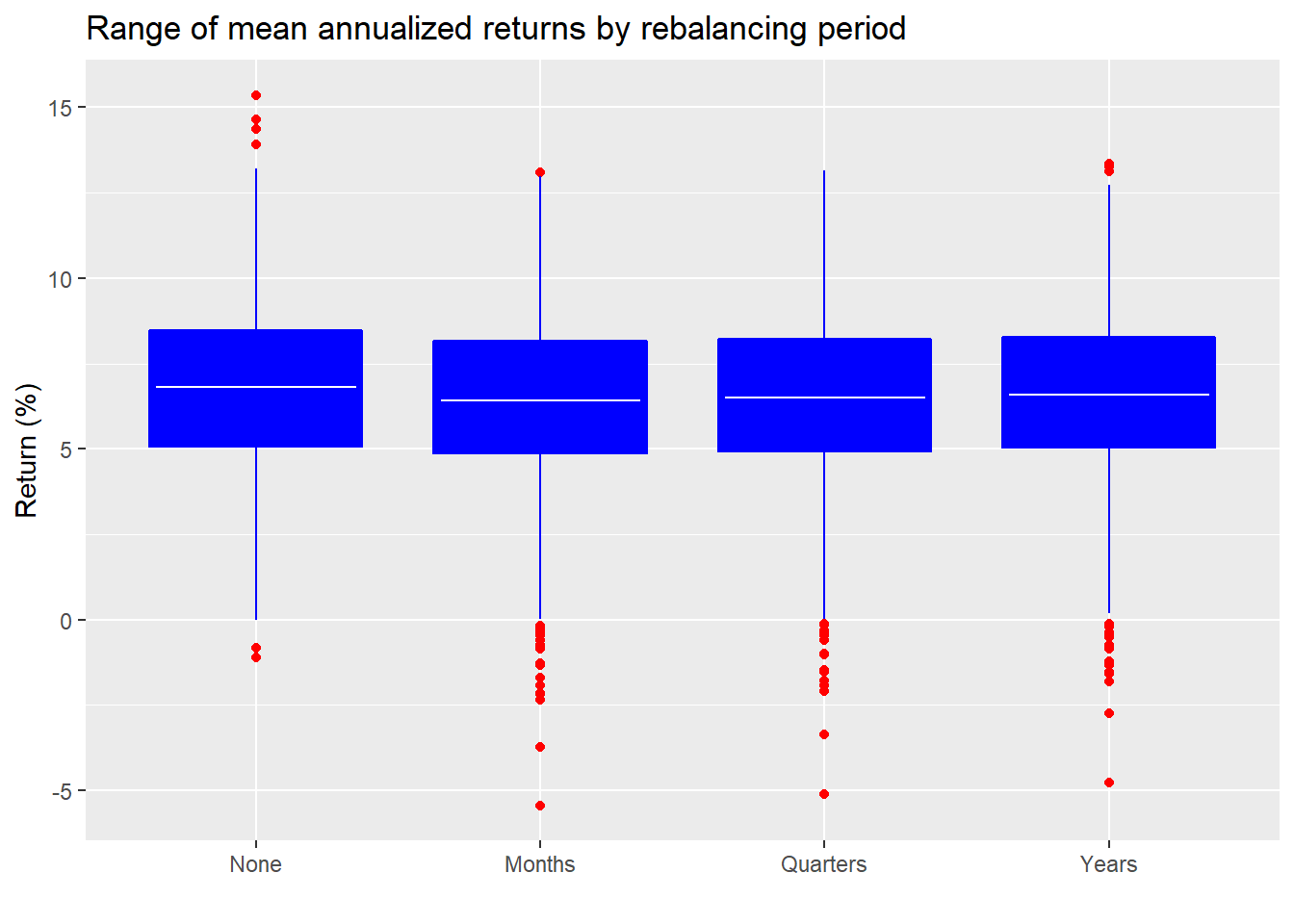

In our last post, we took a quick look at building a portfolio based on the historical averages method for setting return expectations. Beginning in 1987, we used the first five years of monthly return data to simulate a thousand possible portfolio ...