Tactics over strategies

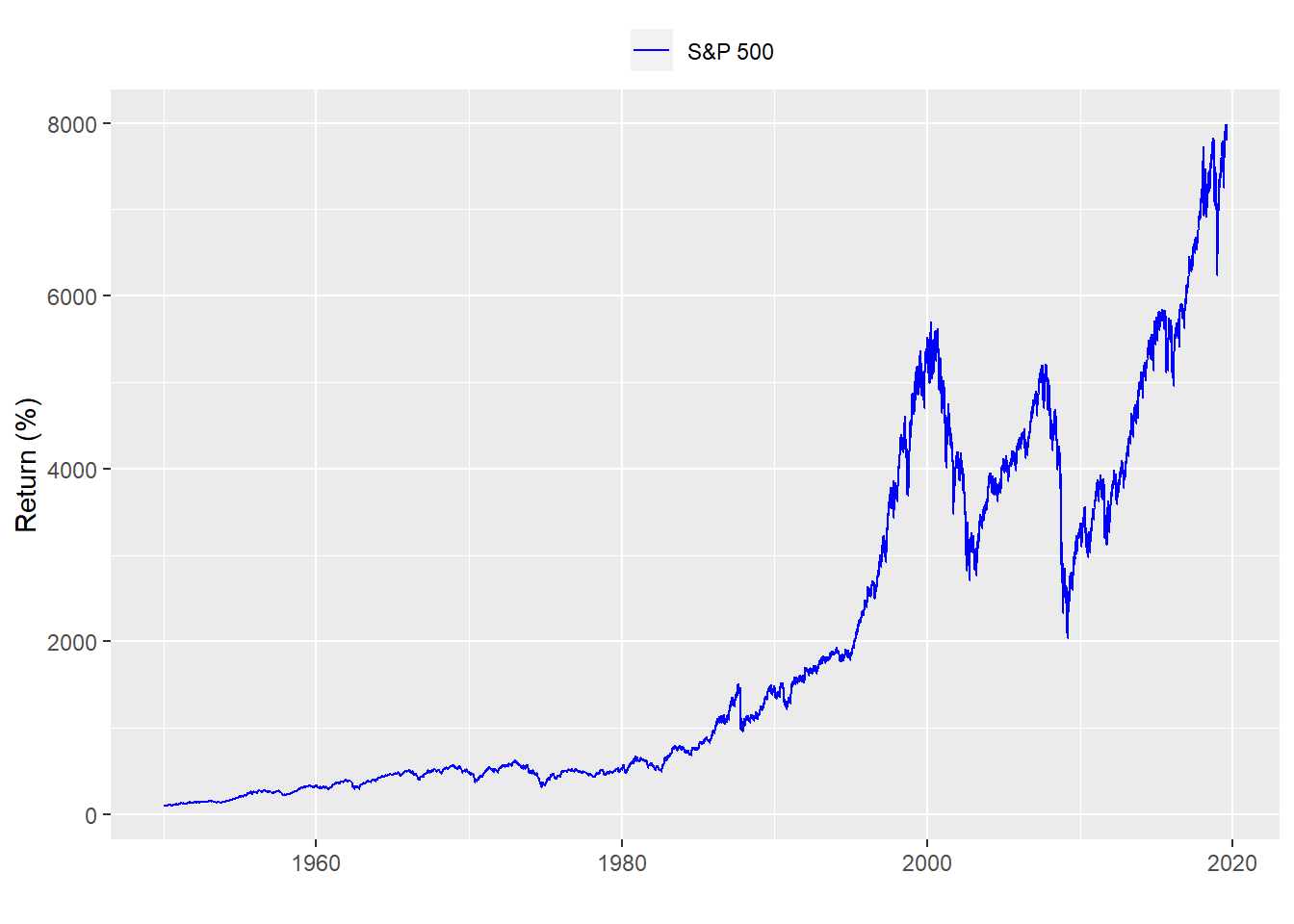

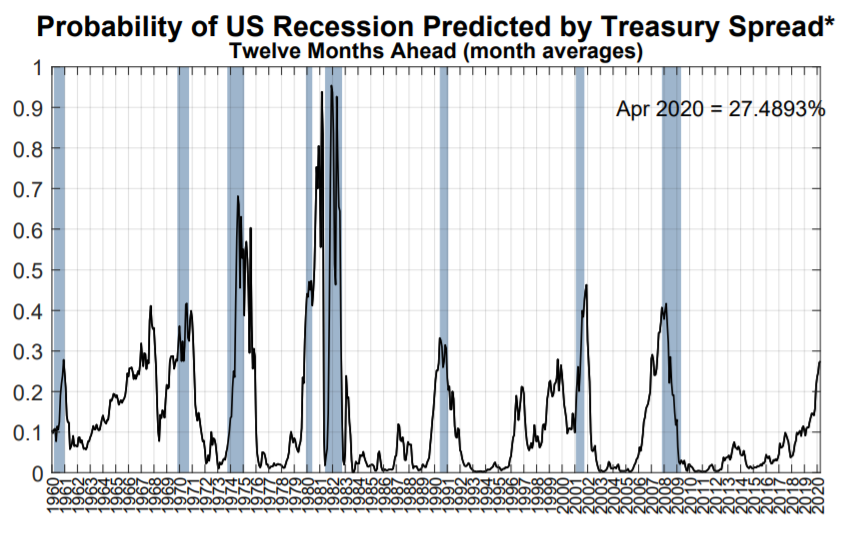

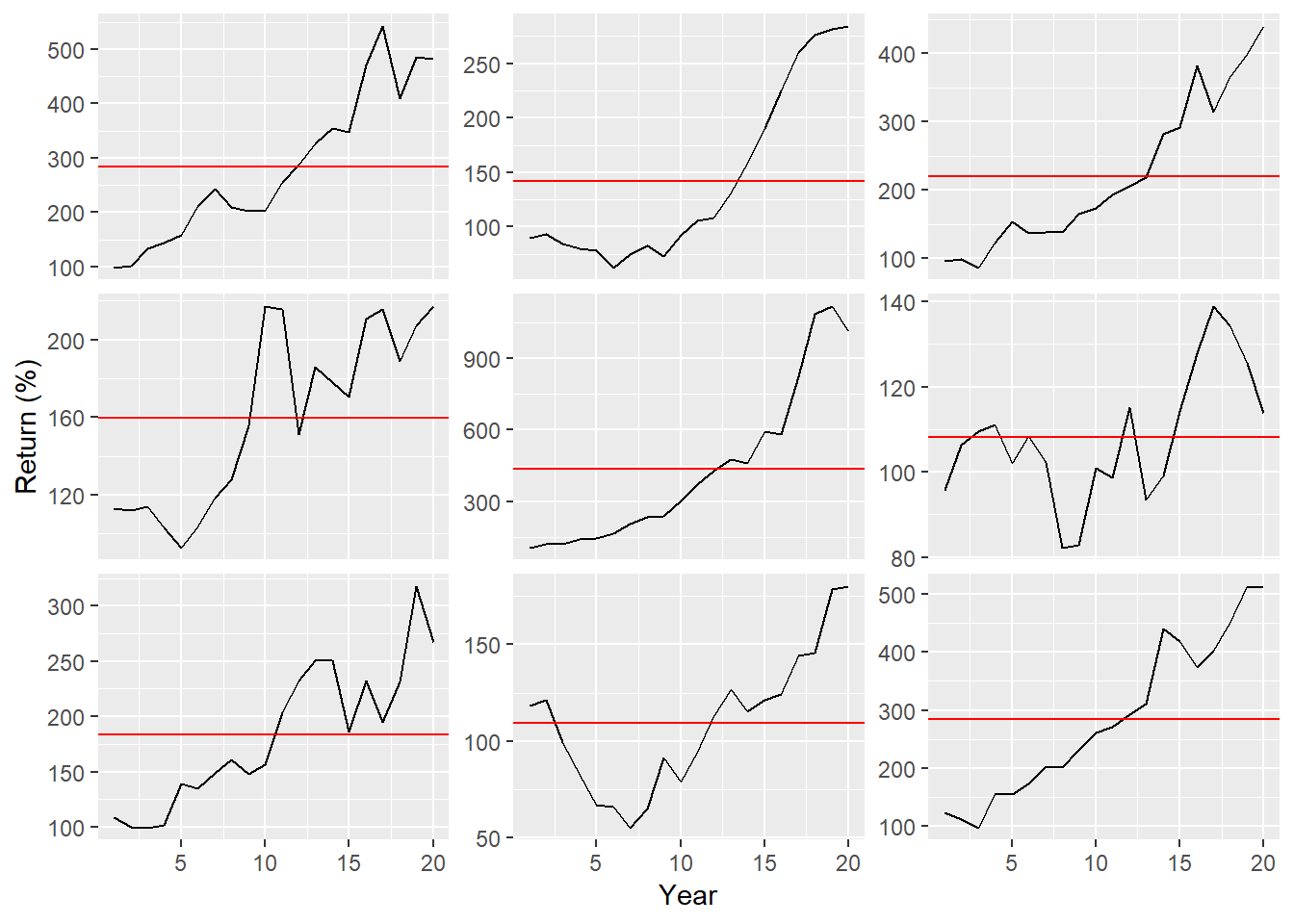

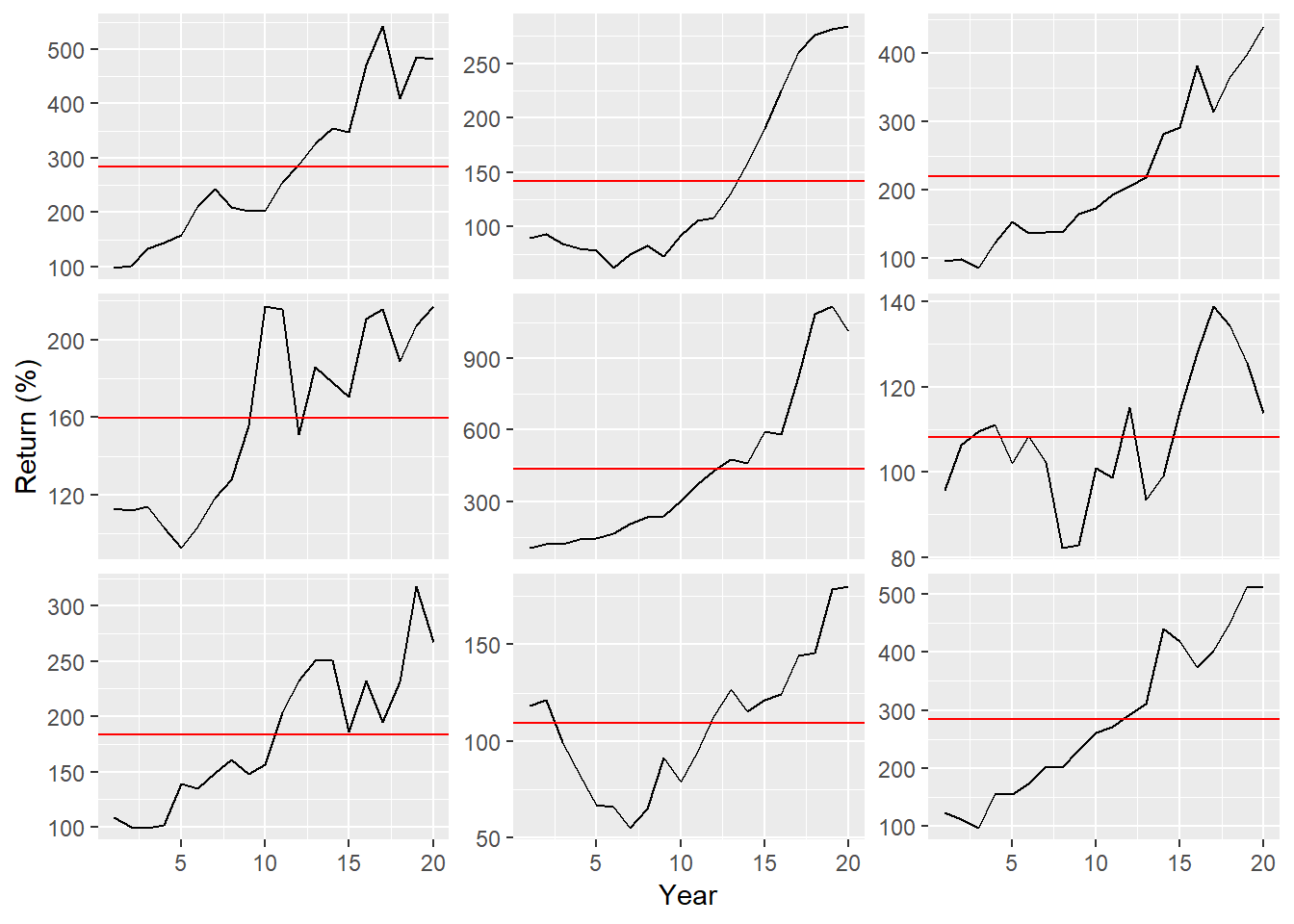

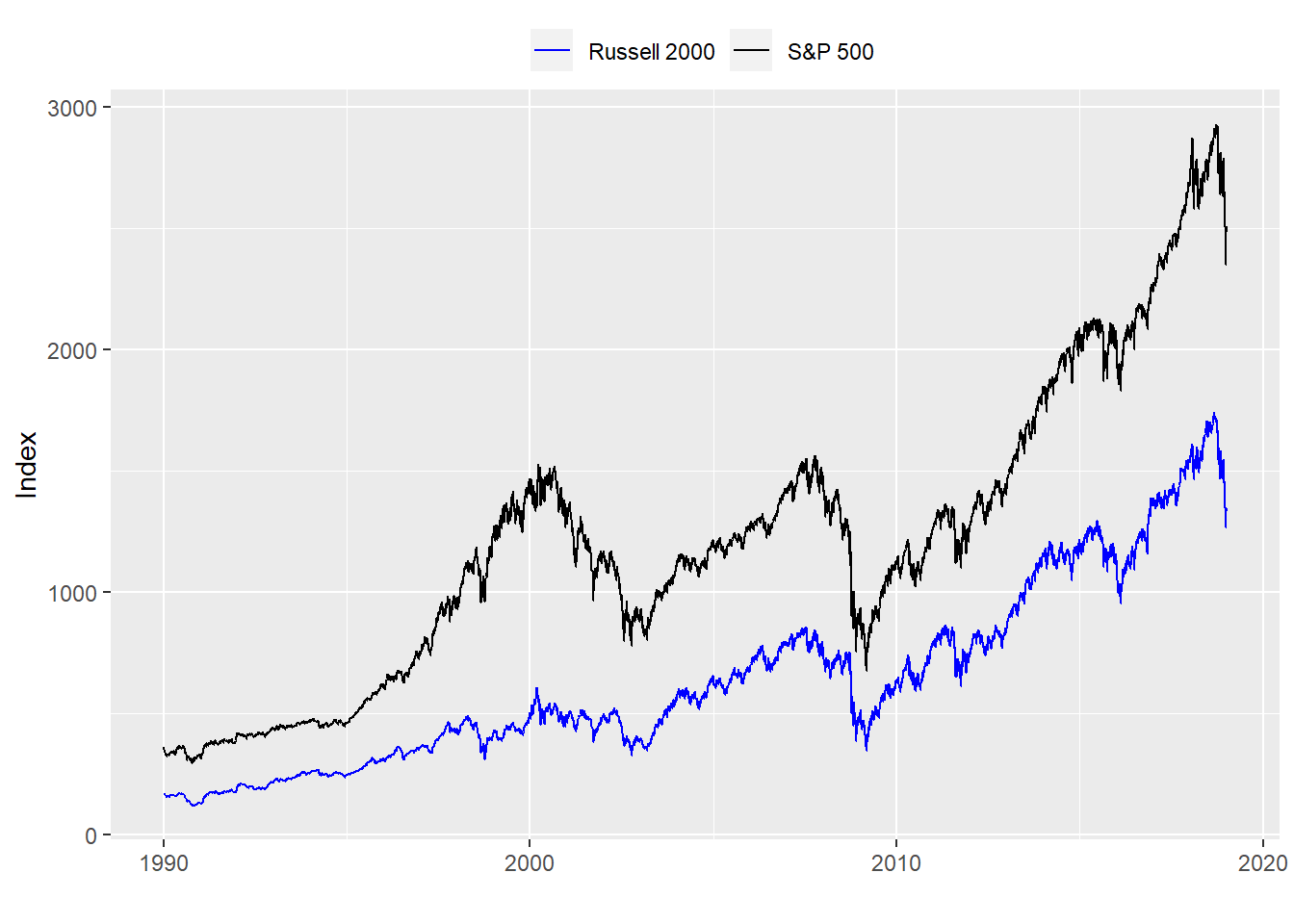

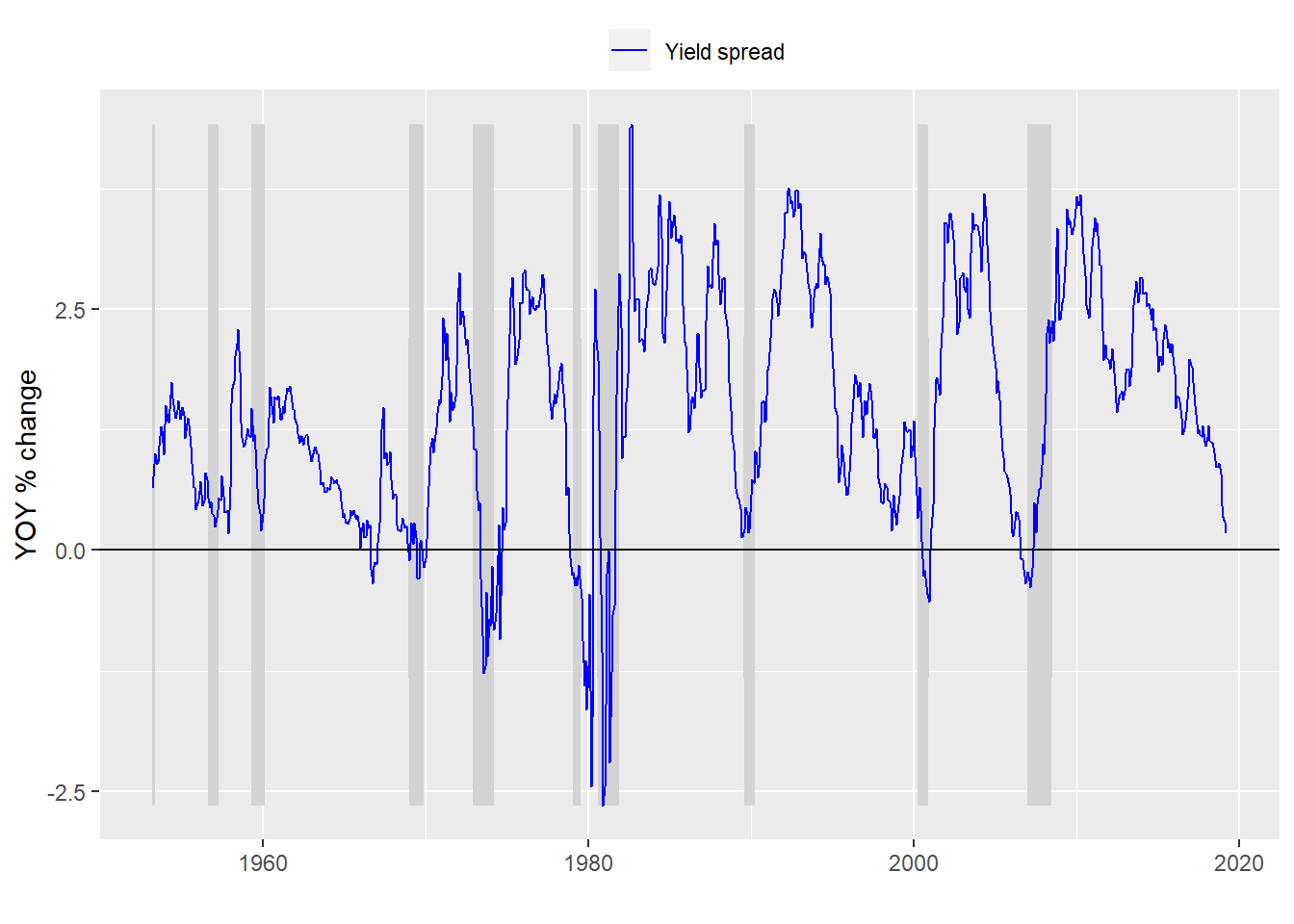

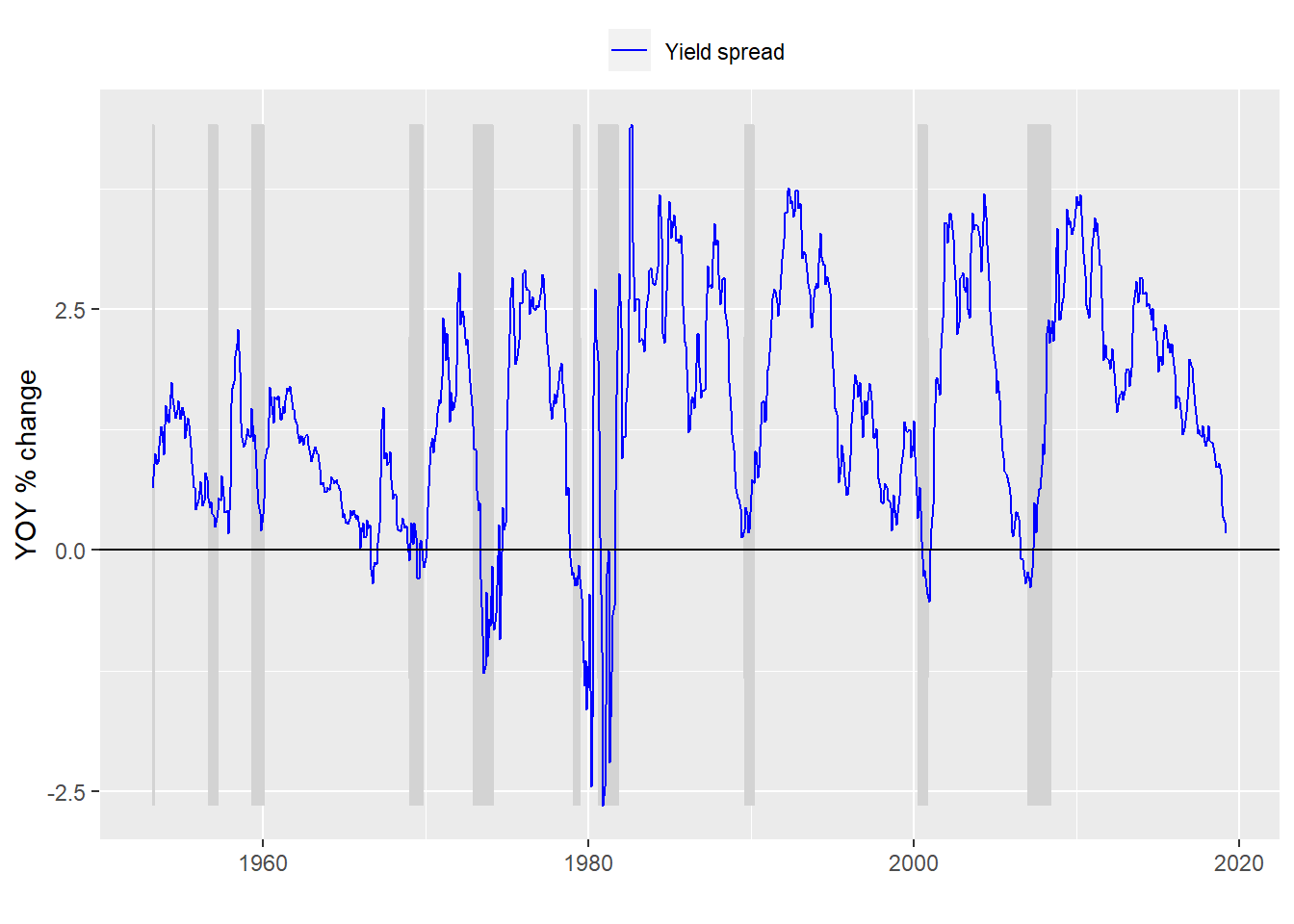

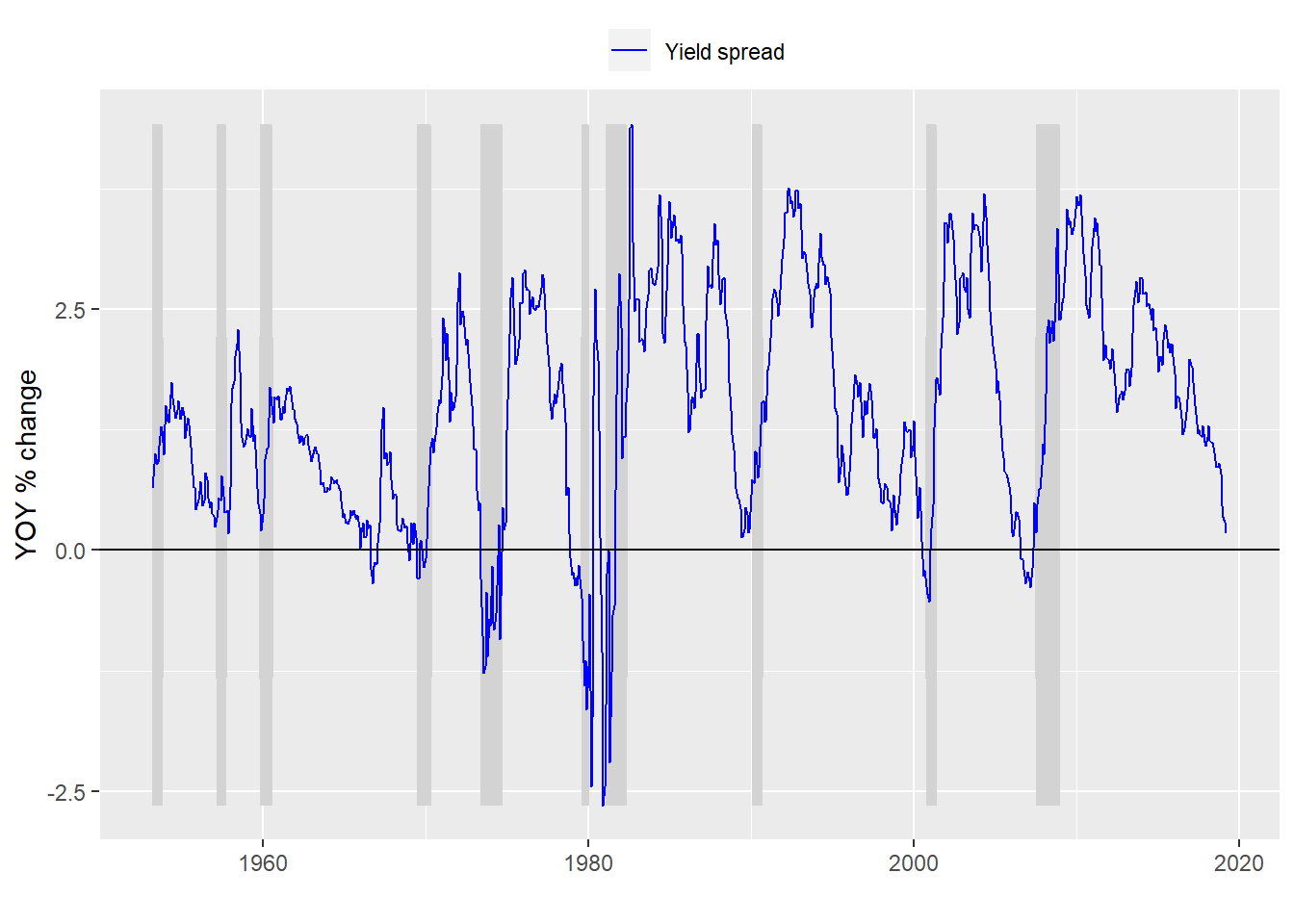

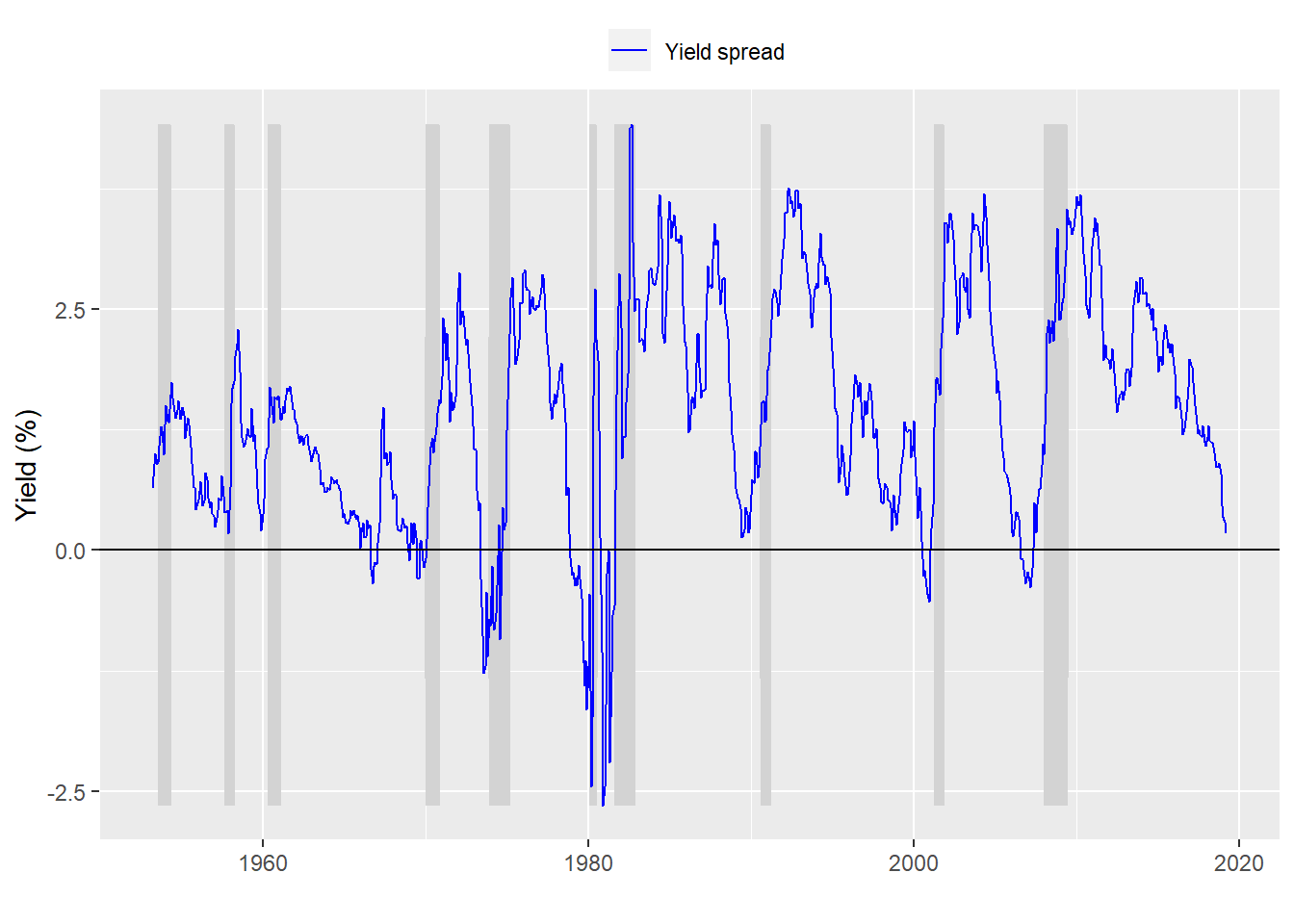

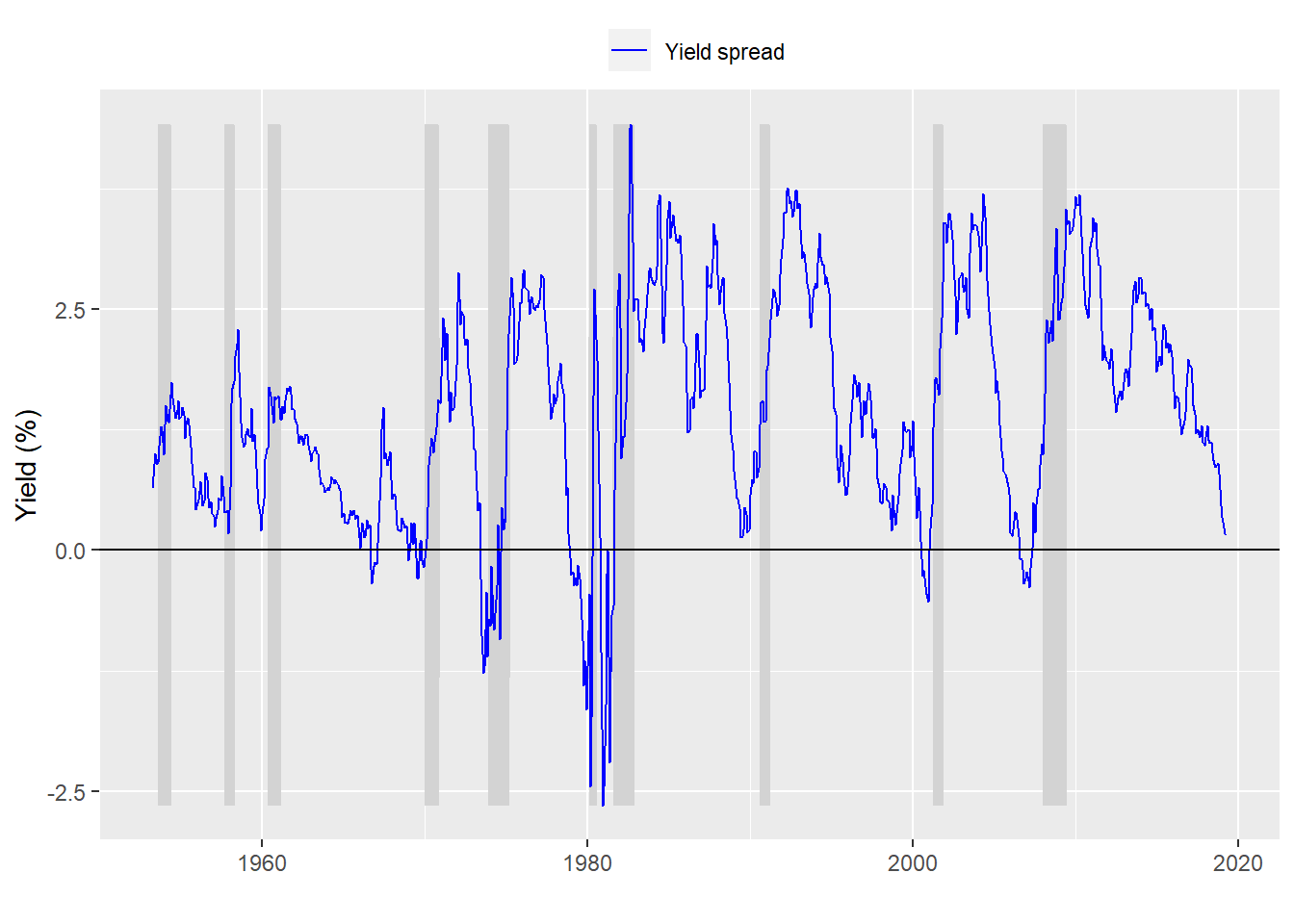

In our last post, we discussed the potential for adding a tactical trigger to execute a strategy. In this case, the strategy is investing in a large cap stock index that allows us achieve a compounded annual return of 7% and limits the yearly deviat...