August 2020

When using shiny in production, often you will want to have some sort of

database interactions for storing and accessing data. The DBI package

provides an easy way to do the database interactions with a variety of

SQL database flavors. In this example, I’m going to use a SQLite ... [Read more...]

How to Optimize a Goal-Based Portfolio

Traditional portfolio optimization (often called modern portfolio theory, or mean-variance optimization) balances expected portfolio return with expected portfolio variance. You input how opposed you are to portfolio variance (your risk tolerance), then you build a portfolio that gives you the best return given your risk tolerance. Goals-based investing, by contrast, ...

F1 2020 -Season So Far and Why Racing Point’s Method of Designing the Car is Controversial

Hello Readers, Today i’m going to do a little data explore of the data from the F1 2020 season so far. Exploring a number of questions about the season so far. First of all looking at qualifying and why a lot of teams are annoyed by (t)Racing Point and ...

VirtuEARL – EARL Conference online 2020

Sadly, we cannot meet in-person for the EARL Conference this year, so we’ve decided to go virtual with an online...

The post VirtuEARL – EARL Conference online 2020 appeared first on Mango Solutions.

[Read more...]

Graphics in R with ggplot2

Introduction

Data

Basic principles of {ggplot2}

Create plots with {ggplot2}

Scatter plot

Line plot

Combination of line and points

Histogram

Density plot

Combination of histogram and densities

Boxplot

Barplot

Further personalization

Title an...

Graphics in R with ggplot2

Introduction

Data

Basic principles of {ggplot2}

Create plots with {ggplot2}

Scatter plot

Line plot

Combination of line and points

Histogram

Density plot

Combination of histogram and densities

Boxplot

Barplot

Further personalization

Labels

Axis ticks

Log transformations

Limits

Legend

Shape, color, size and transparency

Smooth and regression lines

Facets

Themes

Interactive ...

Is second wave coming to London?

The some columns on the data file has changed so I have updated the code from my last post.

It is worrying that the daily number of new cases has risen to the same level as when the lock down started. The speed of the increase remains quite slow however. ...

Summer school: Statistical Methods for Linguistics and Psychology, 2020

The summer school website has been updated with the materials (lecture notes, exercises, and videos) for the Introductory frequentist and Bayesian streams. Details here:

https://vasishth.github.io/smlp2020/

[Read more...]

Top Tips for Learning R from Africa R’s Shelmith Kariuki

If you’re just at the beginning of your journey learning R programming and you're looking for tips, there’s a lot you can learn from Shelmith Kariuki.Shel has years of professional experience working in data science, and years of experience teaching statistics and data skills to others. She’...

Why Package & Environment Management is Critical for Serious Data Science

Photo by Markus Spiske on Unsplash

This is a guest post from RStudio’s partner, ProCogia

The rapid advancement of R presents a challenge to reproducibility

Thanks to our vibrant and engaged community, R is continually evolving as successful ...

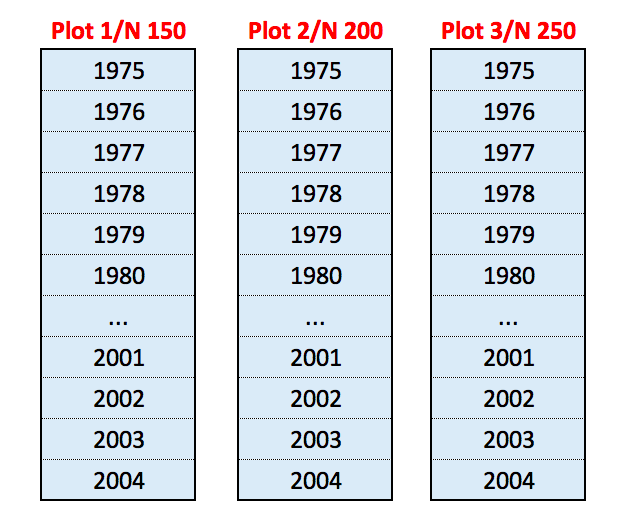

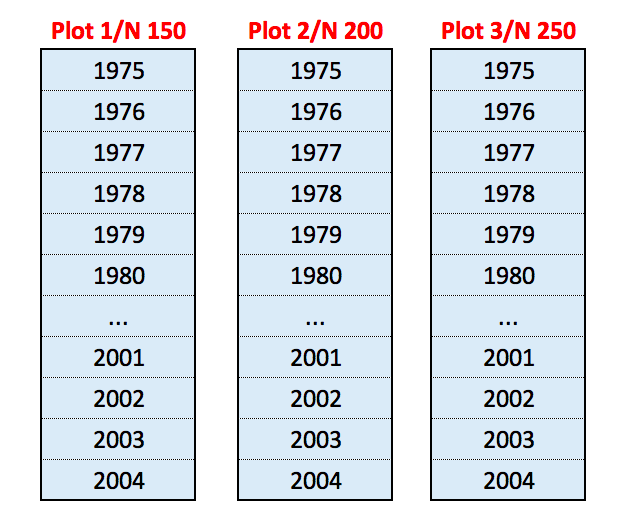

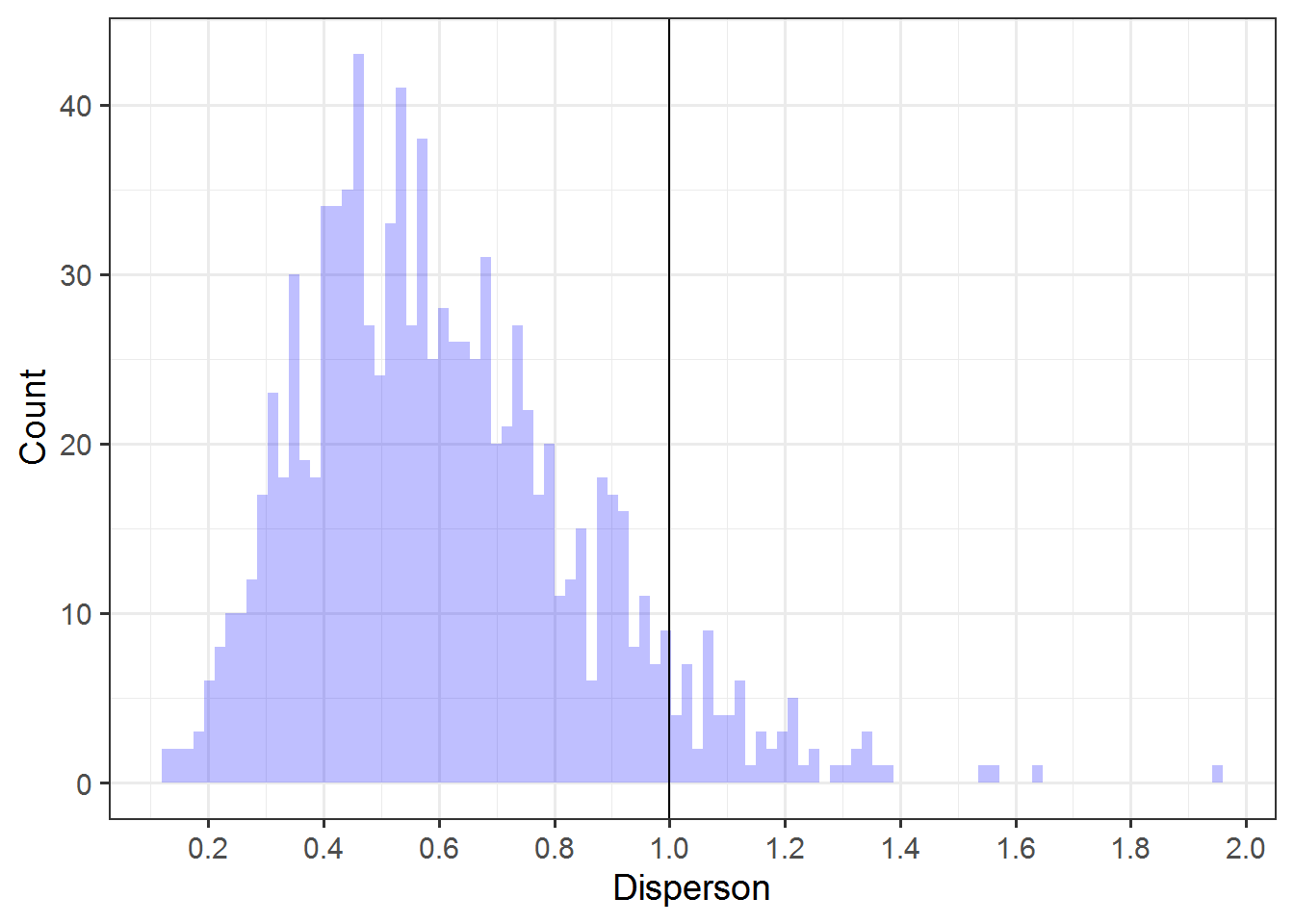

Building ANOVA-models for long-term experiments in agriculture

This is the follow-up of a manuscript that we (some colleagues and I) have published in 2016 in the European Journal of Agronomy (Onofri et al., 2016). I thought that it might be a good idea to rework some concepts to make them less formal, simpler ...

2 Months in 2 Minutes – rOpenSci News, August 2020

rOpenSci HQ

Join our Community Manager Stefanie Butland in a CarpentryCon @ Home fireside chat on Growing Inclusive, Computational Communities and Leaders. Live 90-min discussions Wed Aug 26 21h00 (2pm PDT) and Thu Aug 27 15h00 UTC (8... [Read more...]

Building ANOVA-models for long-term experiments in agriculture

This is the follow-up of a manuscript that we (some colleagues and I) have published in 2016 in the European Journal of Agronomy (Onofri et al., 2016). I thought that it might be a good idea to rework some concepts to make them less formal, simpler to follow and more closely related ...

Simulate! Simulate! – Part 4: A binomial generalized linear mixed model

A post about simulating data from a generalized linear mixed model (GLMM), the fourth post in my simulations series involving linear models, is long overdue. I settled on a binomial example based on a binomial GLMM with a logit link.

I find binomial models the most difficult to grok, primarily ...

Online R trainings by eoda: Learning data science

Unlock the potential of data science with our online R trainings and become an expert of R in September 2020! The speciality: The presence of our experienced data science trainers. Your individual questions will be answered in direct exchange – this ensures the greatest possible learning success for you. Key Facts Location: ...

Time Series in 5-Minutes, Part 1: Data Wrangling and Rolling Calculations

Have 5-minutes? Then let’s learn time series. In this short articles series, I highlight how you can get up to speed quickly on important aspects of time series analysis. Today we are focusing preparing data for timeseries analysis rolling calculatio...

R Packages: {janitor} for Data Cleaning

Github Page as of 8/10/20

Quick Overview

Exploring-Data is a place where I share easily digestible content aimed at making the wrangling and exploration of data more efficient (+fun).

Sign up Here to join the many other subscribers who also nerd out on new tips and tricks ????

And if you enjoy ...

Tenliner Cave Adventure in R: Miniature Text Adventure Ported From the ZX81

Computing has come a long way in the past 75 years. I learned how to write code in the 1980s on my tiny 1 kilobyte ZX81 home computer. With only 1 kilobyte of memory, capabilities were limited, but this machine set me off on an adventure writing code in the BASIC language. An ...

Benford’s Law: Applying to Existing Data

Benford’s Law is one of the most underrated and widely used techniques that are commonly used in various applications. United States IRS neither confirms nor denies their use of Benford’s law to detect any number of manipulations in income tax filing. Across the Atlantic, the EU is very ...

R Exercises – Interview Questions (Stats and Simulation)

For Data Science positions that require some knowledge of Statistics and Programming skills, is common to ask questions like those ... Read moreR Exercises – Interview Questions (Stats and Simulation)

[Read more...]

Copyright © 2022 | MH Corporate basic by MH Themes