R and Shiny Services Custom R Packages and Scalable Shiny Applications for Your Organization

These posts usually load d3po plots/maps and require JS; please click https://pacha.dev/blog/2025/12/23/index.html to continue reading. [Read more...]

A practical introduction to multiple imputation of missing data with the R-package mice workshop

Join our workshop on A practical introduction to multiple imputation of missing data with the R-package mice, which is a part of our workshops for Ukraine series! Here’s some more info: Title: A practical introduction to multiple imputation of missing data with the R-package mice Date: Thursday, January 22nd, 18:00 – 20:00 ... [Read more...]

A Primer in Optimization + The Hitchhiker’apos;s Guide to Linear Models

A tiny book on optimization theory bundled with a practical guide to estimating linear models using R. These posts usually load d3po plots/maps and require JS; please click https://pacha.dev/blog/2025/12/22/optimization-primer/index.html to continue re... [Read more...]

Corrupción, libertad y por qué debemos ser criteriosos al usar regresión lineal

Intento analizar críticamente un post de LinkedIn que afirma que corrupción y libertad son inversamente proporcionales. [Read more...]

My Messy Notes on Building a Super Learner: Peeking Under The Hood of NNLS

📚 Tried building Super Learner from scratch to understand what’s happening under the hood. Walked through the NNLS algorithm step-by-step—turns out ensembling models may beat solo models! Our homegrown version? Surprisingly close to nnls package...

Cartografía Censo 2024 – PostgreSQL

Organicé los archivos Parquet que proporciona el INE para el Censo 2024 en una base de datos PostgreSQL con la extensión PostGIS, facilitando así su consulta y análisis espacial.

How to Analyze Ball-by-Ball Cricket Data in R (cricketdata)

Focus keyphrase: cricket analytics in R • Secondary: R cricket data analysis • Package: cricketdata Cricket analytics is no longer limited to season averages and simple leaderboards. With modern ball-by-ball datasets, we can quantify tempo, isolate phase-specific skills, evaluate matchups, and model outcomes under uncertainty. R is a strong environment for this ... [Read more...]

Introducing docorator to the pharmaverse

Disclaimer: This blog contains opinions that are of the authors alone and do not necessarily reflect the strategy of their respective organizations.

We are pleased to introduce a new addition to the pharmaverse: {docorator}, an R package devel...

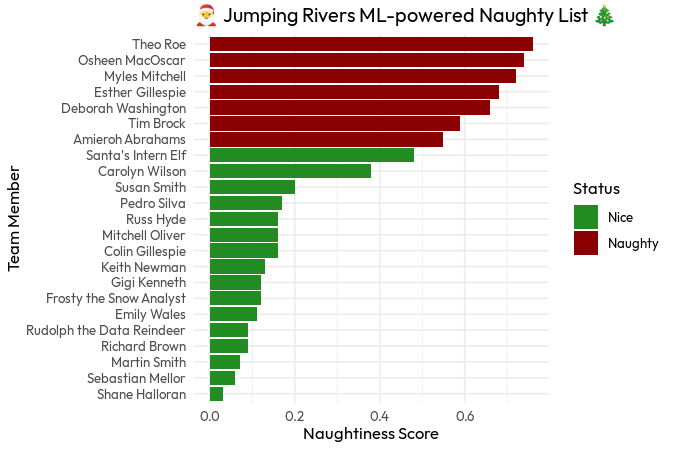

Machine Learning Powered Naughty List: A Festive Jumping Rivers Story

Introduction

Ho ho ho! 🎅 The holiday season is here, and at Jumping Rivers, we’re

decking the halls with data, not just tinsel. While elves are busy

checking their lists twice, we thought: why not bring a little machine

learning magic to Christmas? After all, what’s more festive than

...

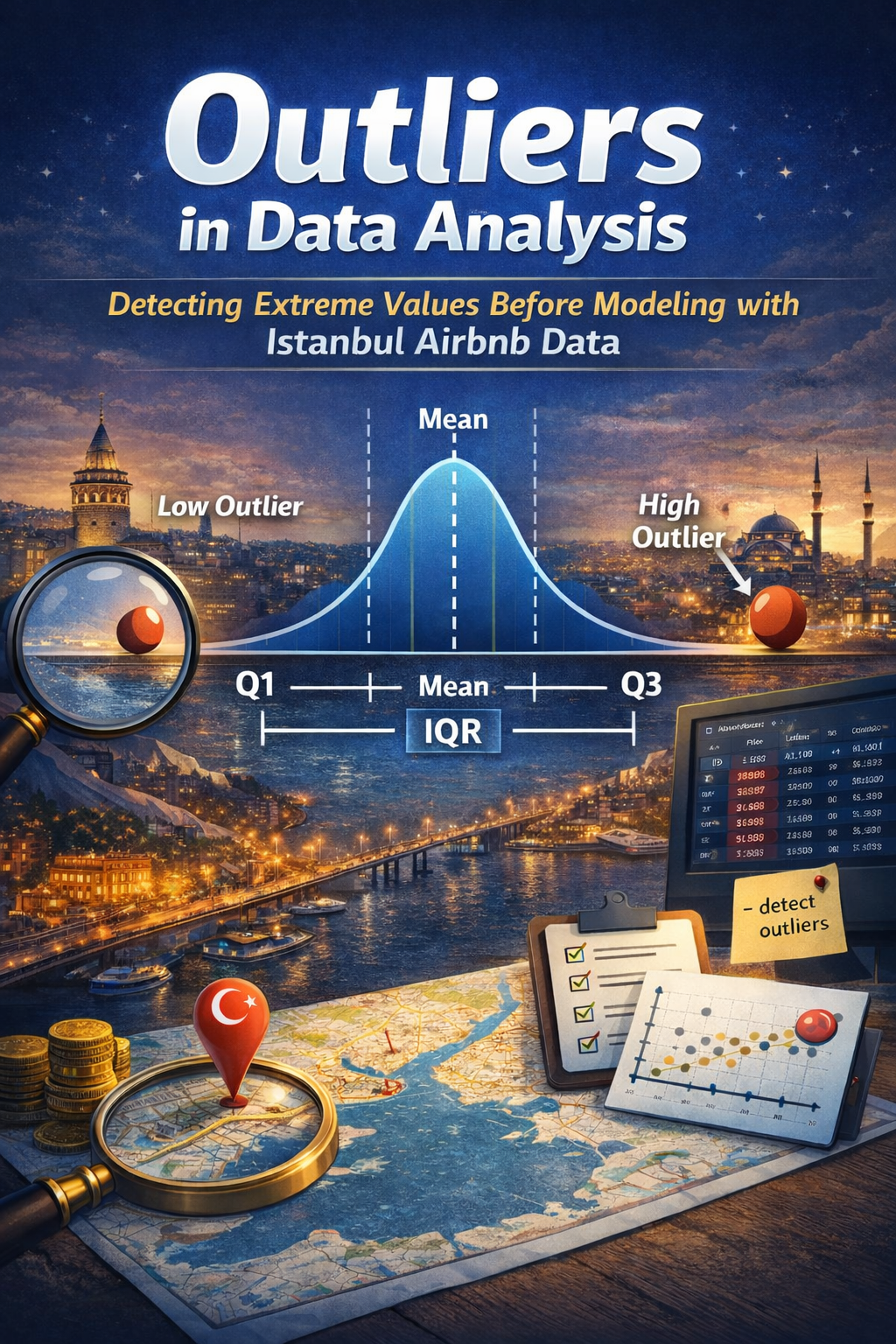

Outliers in Data Analysis: Detecting Extreme Values Before Modeling in R with İstanbul Airbnb Data

1 Introduction

Data preprocessing is often presented as a sequence of technical steps. However, each preprocessing decision implicitly embeds a statistical assumption.

In a previous article, I discussed how missing observations can bias a...

How to draw the Economist-style graph with ggplot2 in R?

I think everyone agrees on the fact that the Economist magazine produces very-well designed graphics, sometimes the best in the world. The success behind their graph lies on the ability of explaining complex matters in a simpler way by employing traditional data visualization techniques such as line graph or bar ...

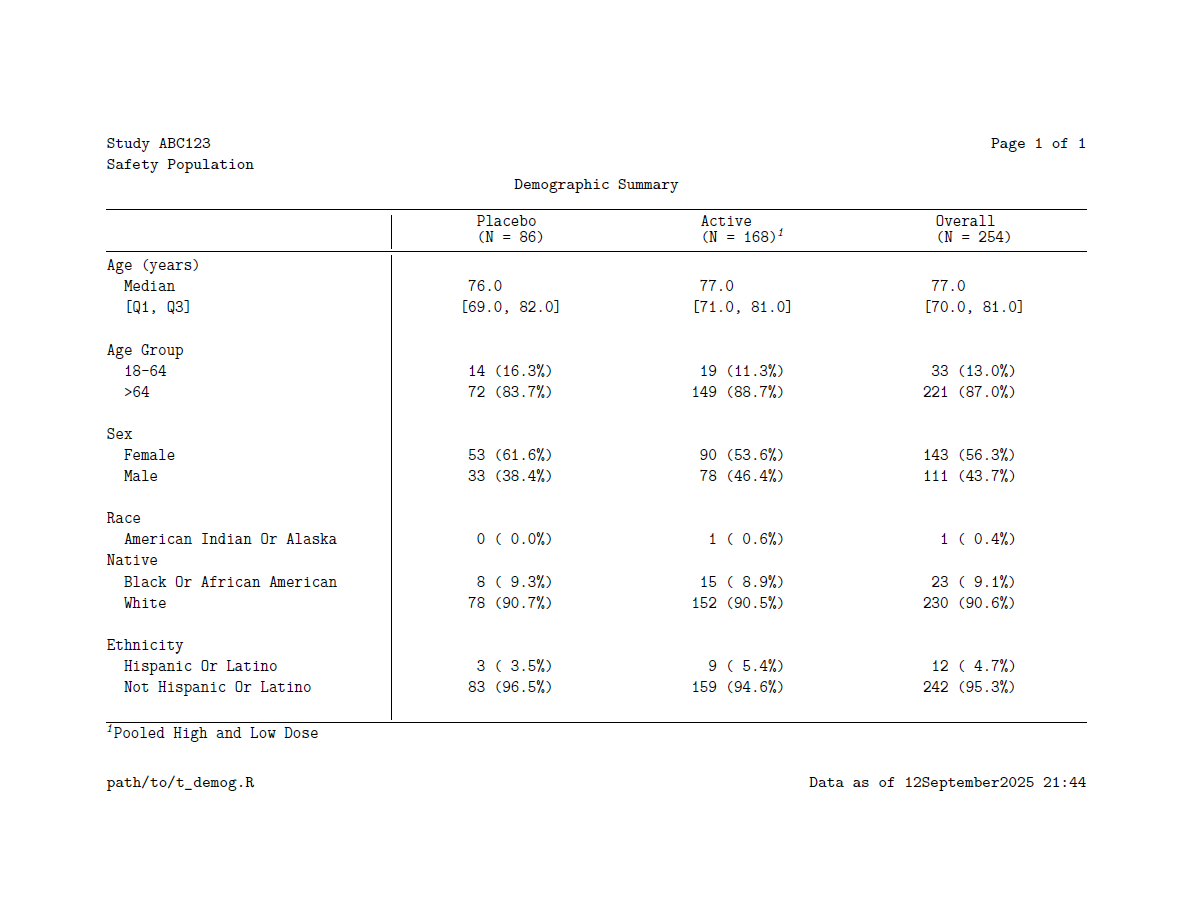

Explore the Pharmaverse Examples: Your Gateway to Clinical Reporting with Open-Source Tools

🔍 Pharmaverse Examples Highlights

If you’re navigating the world of clinical reporting with modern tooling or are curious about open-source tooling then the pharmaverse examples site is your one-stop-shop! This living collection of end-to-end... [Read more...]

rOpenSci News Digest, December 2025

Dear rOpenSci friends, it’s time for our monthly news roundup! You can read this post on our blog. Now let’s dive into the activity at and around rOpenSci!

rOpenSci HQ

rOpenSci at LatinR

We proudly continued supporting LatinR as a comm... [Read more...]

Code Hosting Options Beyond GitHub

rOpenSci makes heavy use of GitHub for our projects and services, including software peer-review.

GitHub is by far the most widely used git or code-hosting platform, and the combination of its popularity and freemium services have made it central to o... [Read more...]

Finally figured out a way to port python packages to R using uv and reticulate: example with nnetsauce

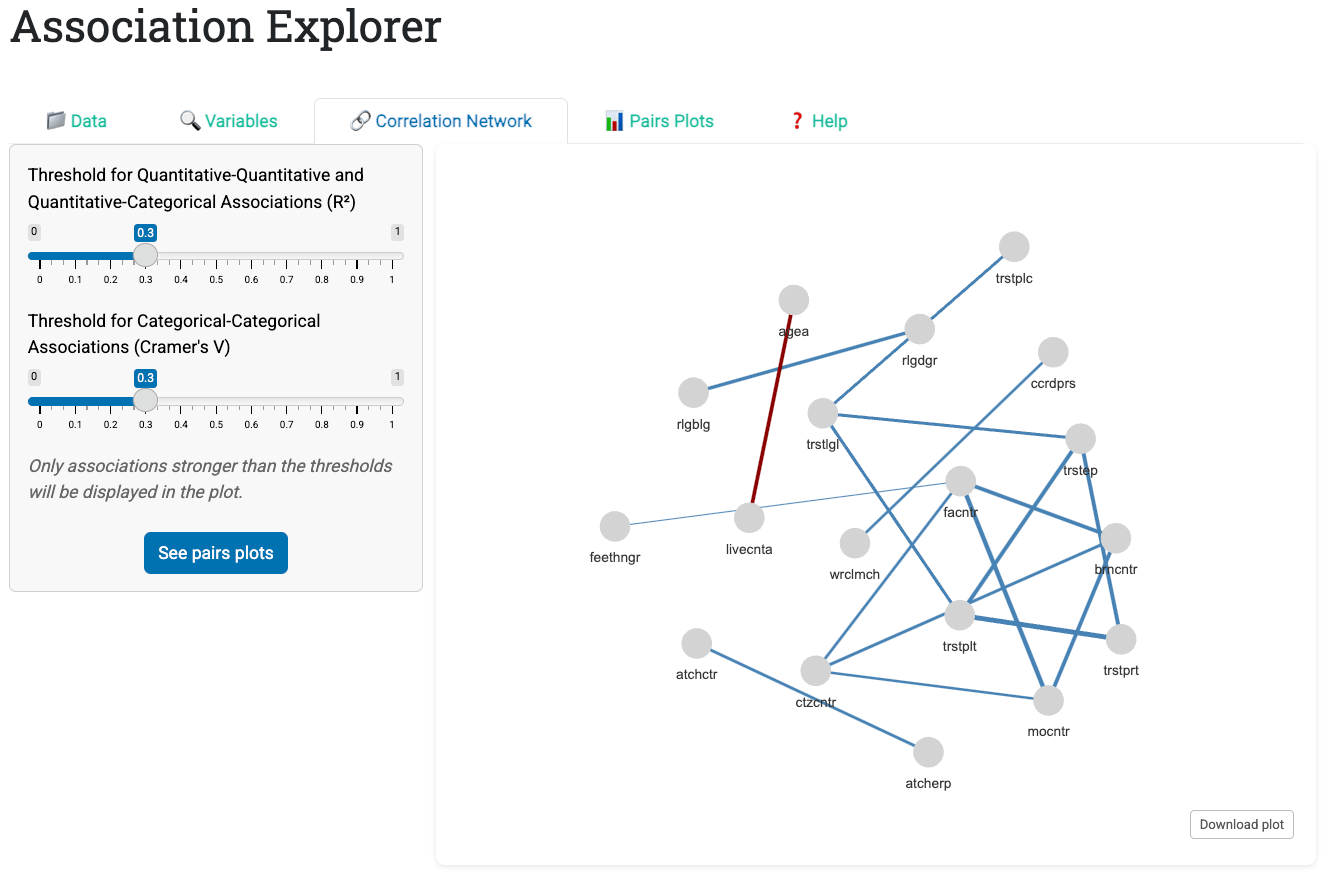

AssociationExplorer: A user-friendly shiny application for exploring associations and visual patterns

I am pleased to announce the publication of our paper “AssociationExplorer: A user-friendly Shiny application for exploring associations and visual patterns” in the journal SoftwareX, together with the official release of the AssociationExplorer2 R...

Set Operations with freeCount

In general, set operations are very useful for comparing lists of things. These lists can contain any strings, such as gene or species names. Set operations are also a good way to identify unique or shared genes across sets of analysis results. The freeCount SO app will help you perform ...

R Package Development in Positron workshop

Join our workshop on R Package Development in Positron, which is a part of our workshops for Ukraine series! Here’s some more info: Title: R Package Development in Positron Date: Thursday, January 15th, 18:00 – 20:00 CET (Rome, Berlin, Paris timezone) Speaker: Stephen D. Turner is an associate professor of data science ... [Read more...]

Better Code, Without Any Effort, Without Even AI

We are experiencing a programming revolution, with the democratization of artificial intelligence, but also with the creation and improvement of more traditional software tools to improve your code: local, free, deterministic.

In this post, we will in... [Read more...]

Elephant(s) in the room: Graph neural networks, embeddings, and foundation models in spatial data science

Slides: https://jakubnowosad.com/agforum2025

This presentation covered three interconnected deep learning concepts appearing in spatial data science work.

Graph Neural Networks (GNNs) are a deep learning architecture that represents spatial dat...

Copyright © 2026 | MH Corporate basic by MH Themes