Forecasting the next decade in the stock market using time series models

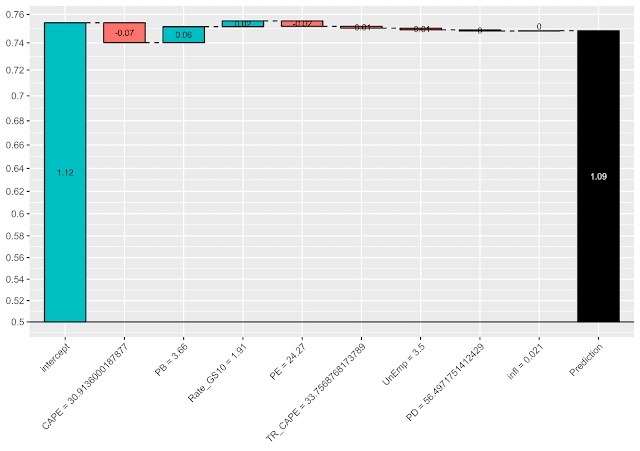

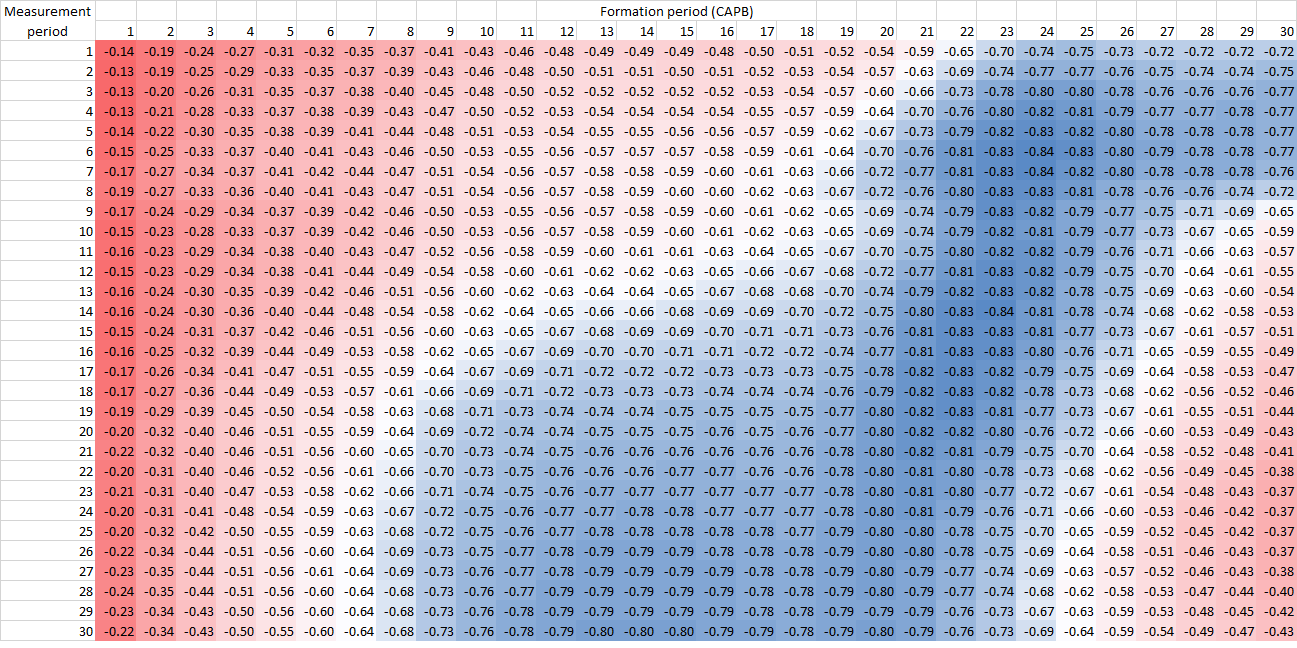

This post will introduce one way of forecasting the stock index returns on the US market. Typically, single measures such as CAPE have been used to do this, but they lack accuracy compared to using many variables and can also have different relationships with returns on different markets. Furthermore, it ...