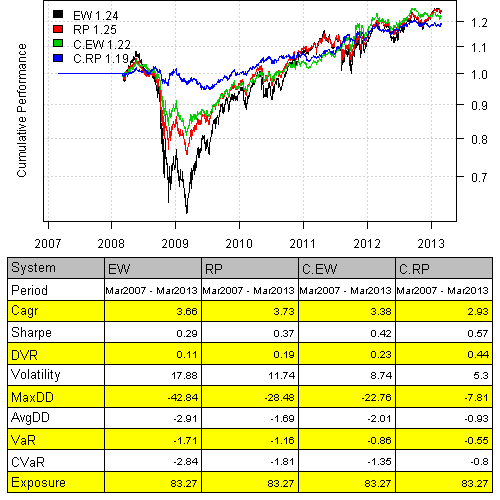

Cluster Risk Parity back-test

Want to share your content on R-bloggers? click here if you have a blog, or here if you don't.

In the Cluster Portfolio Allocation post, I have outlined the 3 steps to construct Cluster Risk Parity portfolio. At each rebalancing period:

- Create Clusters

- Allocate funds within each Cluster using Risk Parity

- Allocate funds across all Clusters using Risk Parity

I created a helper function distribute.weights() function in strategy.r at github to automate these steps. It has 2 parameters:

- Function to allocate funds. For example, risk.parity.portfolio, will use use risk parity to allocate funds both within and across clusters.

- Function to create clusters. For example, cluster.group.kmeans.90, will create clusters using k-means algorithm

Here is the example how to put it all together. Let’s first load historical prices for the 10 major asset classes:

###############################################################################

# Load Systematic Investor Toolbox (SIT)

# http://systematicinvestor.wordpress.com/systematic-investor-toolbox/

###############################################################################

setInternet2(TRUE)

con = gzcon(url('http://www.systematicportfolio.com/sit.gz', 'rb'))

source(con)

close(con)

#*****************************************************************

# Load historical data for ETFs

#******************************************************************

load.packages('quantmod')

tickers = spl('GLD,UUP,SPY,QQQ,IWM,EEM,EFA,IYR,USO,TLT')

data <- new.env()

getSymbols(tickers, src = 'yahoo', from = '1900-01-01', env = data, auto.assign = T)

for(i in ls(data)) data[[i]] = adjustOHLC(data[[i]], use.Adjusted=T)

bt.prep(data, align='remove.na')

Next, let’s run the 2 versions of Cluster Portfolio Allocation using Equal Weight and Risk Parity algorithms to allocate funds:

#***************************************************************** # Code Strategies #****************************************************************** periodicity = 'months' lookback.len = 250 cluster.group = cluster.group.kmeans.90 obj = portfolio.allocation.helper(data$prices, periodicity = periodicity, lookback.len = lookback.len, min.risk.fns = list( EW=equal.weight.portfolio, RP=risk.parity.portfolio, C.EW = distribute.weights(equal.weight.portfolio, cluster.group), C.RP=distribute.weights(risk.parity.portfolio, cluster.group) ) ) models = create.strategies(obj, data)$models

Finally, let’s examine the results:

#***************************************************************** # Create Report #****************************************************************** strategy.performance.snapshoot(models, T)

The Cluster Portfolio Allocation produce portfolios with better risk-adjusted returns and smaller drawdowns.

To view the complete source code for this example, please have a look at the bt.cluster.portfolio.allocation.test1() function in bt.test.r at github.

R-bloggers.com offers daily e-mail updates about R news and tutorials about learning R and many other topics. Click here if you're looking to post or find an R/data-science job.

Want to share your content on R-bloggers? click here if you have a blog, or here if you don't.