Writing from R to Excel with xlsx

Want to share your content on R-bloggers? click here if you have a blog, or here if you don't.

Paul Teetor, who is doing yeoman’s duty as one of the organizers of the Chicago R User Group (CRUG), asked recently if I would do a short presentation about a “favorite package”. I picked xlsx, one of the many packages that provides a bridge between spreadsheets and R. Here are the slides from my presentation last night; the script is below.

I’ll be honest with you – I use more than one package for reading and writing spreadsheets. But this was a good opportunity for me to dig into some unique features of xlsx and I think the results are worth recommending.

A key feature for me is that xlsx uses the Apache POI API, so Excel isn’t needed. Apache POI is a mature, separately developed API between Java and Excel 2007. That project is focused on creating and maintaining Java APIs for manipulating file formats based on the Office Open XML standards (OOXML) and Microsoft’s OLE 2 Compound Document format (OLE2). As xlsx uses the rJava package to link Java and R, the heavy lifting of parsing XML schemas is being done in Java rather than in R.

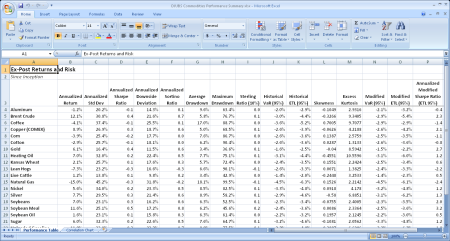

A few notes about the following script. I’m not a fan of toy examples, so I wanted to pull from a small part of my workflow – a bit of an actual report that I generate regularly. The table I picked needed to be sufficiently complex to show that xlsx could really do the job. I ended up covering only a small portion of the example below in the presentation, given the limited time. I chose to emphasize xlsx’s very useful formatting capabilities rather than its ability to read in sheets, since that is well covered elsewhere too.

There’s good news and bad news. The good news is that xlsx may save you a significant amount of manual formatting if you are producing regular analyses into Excel. The bad news is that I picked a table function to show that isn’t in PerformanceAnalytics yet. So the example code isn’t quite self-contained. Sorry about that. Pick a different table (or create your own) and alter the script below, and you’ll quickly understand the ins-and-outs of this package.

Oh, and I’d ask that anyone who has suggestions for making this script more efficient to please let me know…

### Presentation to Chicago R-User's Group (CRUG) on May 1, 2013 ### Peter Carl ### Favorite Packages: xlsx ### Overview # Package: xlsx # Type: Package # Title: Read, write, format Excel 2007 and Excel 97/2000/XP/2003 files # Version: 0.5.0 # Date: 2012-09-23 # Depends: xlsxjars, rJava # Author and Maintainer: Adrian A. Dragulescu <[email protected]> # License: GPL-3 # URL: http://code.google.com/p/rexcel/ ### Installation # Get it from CRAN # install.packages(xlsx) ### Preparing the workspace require(PerformanceAnalytics) require(xlsx) ### Reading from an Excel worksheet # Download the file using wget url <- "http://www.djindexes.com/mdsidx/downloads/xlspages/ubsci_public/DJUBS_full_hist.xls" system(paste('wget ', url)) # Read in the workbook data on the second sheet # x = read.xlsx("DJUBS_full_hist.xls", sheet="sheet"Total Return", stringsAsFactors=FALSE) # Too slow for big spreadsheets x <- read.xlsx2("DJUBS_full_hist.xls", sheetName="Total Return", header=TRUE, startRow=3, as.data.frame=TRUE, stringsAsFactors=FALSE, colClasses=c("Date", rep("numeric", 100))) # The read.xlsx2 function does more work in Java so it achieves better performance (an order of magnitude faster on sheets with 100,000 cells or more). Much faster, but dates come in as numeric unless specified in colClasses. # Or the result can be fixed with this... # excelDate2Date <- function(excelDate) { # originally from HFWutils pkg, now abandoned # Date <- excelDate + as.Date("1900-01-01") - 2 # ## FIXME: add "if >1900-Feb-28" switch? # return(Date) # } # Read the more descriptive headings from a specific sheet x.tags <- read.xlsx2("DJUBS_full_hist.xls", sheetName="Total Return", header=FALSE, startRow=1, endRow=3, as.data.frame=TRUE, stringsAsFactors=FALSE) # head(x, n=10) # get a sense of what we've read in # tail(x, n=10) # the author has some notes at the end of the data # # Comes in as a mix of classes in a data.frame # > class(x) # [1] "data.frame" # > class(x[2,2]) # [1] "numeric" # > class(x[1,1]) # [1] "Date" ### Parsing the data # Everything was read in as a string, except for a few NA's at the end # x = na.omit(x) # Get rid of the last two lines, which contains the disclaimer x = x[-which(is.na(x[,1])),] # Remove blank columns between sections for both the data and the tags x = x[,-which(lapply(x,function(x)all(is.nan(x)))==TRUE)] x.tags = x.tags[,-which(apply(x.tags,2,function(x)all(x=="")))] # Parse the dates, remembering that Excel does not keep track of time zones and DST x.ISOdates = x[,1] # Convert data into a time series of prices x.P=as.xts(x[-1], order.by=x.ISOdates) # Rename the columns using something more descriptive colnames(x.P) = x.tags[2,-1] # Use the descriptive data to identify subsets # > unique(as.character(x.tags[1,])) # [1] "" "Currency" "Subindex" "Individual Commodities" # [5] "Additional Commodities" # Use subsetting to get a vector of column names # > as.character(x.tags[2, which(x.tags[1,]=="Subindex")]) # [1] "Agriculture" "Energy" "ExEnergy" "Grains" "Industrial Metals" # [6] "Livestock" "Petroleum" "Precious Metals" "Softs" "Composite Crude" # [11] "Composite Wheat" x.subindexes = as.character(x.tags[2, which(x.tags[1,]=="Subindex")]) # > as.character(x.tags[2, grep("Commodities", x.tags[1,])]) # [1] "Aluminum" "Brent Crude" "Coffee" "Copper (COMEX)" "Corn" # [6] "Cotton" "Gold" "Heating Oil" "Kansas Wheat" "Lean Hogs" # [11] "Live Cattle" "Natural Gas" "Nickel" "Silver" "Soybeans" # [16] "Soybean Meal" "Soybean Oil" "Sugar" "Unleaded Gasoline" "Wheat" # [21] "WTI Crude Oil" "Zinc" "Cocoa" "Lead" "Platinum" # [26] "Tin" x.commodities = as.character(x.tags[2, grep("Commodities", x.tags[1,])]) # Calculate returns from prices x.R = Return.calculate(x.P[,x.commodities]) # --- Slide 0 --- # > head(x.R) # Aluminum Brent Crude Coffee Copper (COMEX) Corn Cotton Gold # 1991-01-02 NA NA NA NA NA NA NA # 1991-01-03 0.0110040000 -0.045238000 0.0138090000 -0.024966000 0.002338000 0.013373000 -0.005445000 # 1991-01-04 0.0004599388 -0.058984333 -0.0037413359 -0.003259374 0.006639477 -0.002423589 -0.004190819 # 1991-01-07 0.0060614809 0.150057989 0.0174145756 0.008306786 0.008027806 -0.007552549 0.023785651 # 1991-01-08 -0.0166027909 -0.026213992 0.0007347181 -0.019509577 -0.011495507 -0.003766638 -0.009661283 # 1991-01-09 -0.0055101154 0.008863234 -0.0031341165 -0.008988240 -0.004114776 -0.002593289 0.001912069 # ... ### Analyzing the data # --- Slide 1 --- # Create a table of summary statistics x.AnnRet = t(table.AnnualizedReturns(x.R), Rf=0.3/12) x.RiskStats = as.data.frame(t(table.RiskStats(x.R))) # > x.RiskStats # Annualized Return Annualized Std Dev Annualized Sharpe Ratio Annualized Downside Deviation # Aluminum -0.0110 0.2022 -0.0542 0.1433 # Brent Crude 0.1233 0.3080 0.4002 0.2156 # Coffee -0.0403 0.3745 -0.1075 0.2551 # Copper (COMEX) 0.0909 0.2690 0.3379 0.1873 # Corn -0.0387 0.2538 -0.1525 0.1769 # ... ### Writing the resulting table to an Excel worksheet # --- Slide 2 --- # Create a new workbook for outputs outwb <- createWorkbook() # Define some cell styles within that workbook csSheetTitle <- CellStyle(outwb) + Font(outwb, heightInPoints=14, isBold=TRUE) csSheetSubTitle <- CellStyle(outwb) + Font(outwb, heightInPoints=12, isItalic=TRUE, isBold=FALSE) csTableRowNames <- CellStyle(outwb) + Font(outwb, isBold=TRUE) csTableColNames <- CellStyle(outwb) + Font(outwb, isBold=TRUE) + Alignment(wrapText=TRUE, h="ALIGN_CENTER") + Border(color="black", position=c("TOP", "BOTTOM"), pen=c("BORDER_THIN", "BORDER_THICK")) csRatioColumn <- CellStyle(outwb, dataFormat=DataFormat("0.0")) # ... for ratio results csPercColumn <- CellStyle(outwb, dataFormat=DataFormat("0.0%")) # ... for percentage results # --- Slide 3 --- # Which columns in the table should be formatted which way? RiskStats.colRatio = list( '3'=csRatioColumn, '5'=csRatioColumn, '8'=csRatioColumn, '15'=csRatioColumn) RiskStats.colPerc =list( '1'=csPercColumn, '2'=csPercColumn, '4'=csPercColumn, '6'=csPercColumn, '7'=csPercColumn, '9'=csPercColumn, '10'=csPercColumn, '13'=csPercColumn, '14'=csPercColumn) # --- Slide 4 --- # Create a sheet in that workbook to contain the table sheet <- createSheet(outwb, sheetName = "Performance Table") # Add the table calculated above to the sheet addDataFrame(x.RiskStats, sheet, startRow=3, startColumn=1, colStyle=c(RiskStats.colPerc,RiskStats.colRatio), colnamesStyle = csTableColNames, rownamesStyle=csTableRowNames) setColumnWidth(sheet,colIndex=c(2:15),colWidth=11) setColumnWidth(sheet,colIndex=16,colWidth=13) setColumnWidth(sheet,colIndex=17,colWidth=6) setColumnWidth(sheet,colIndex=1,colWidth=0.8*max(length(rownames(x.RiskStats)))) # --- Slide 5 --- # Create the Sheet title ... rows <- createRow(sheet,rowIndex=1) sheetTitle <- createCell(rows, colIndex=1) setCellValue(sheetTitle[[1,1]], "Ex-Post Returns and Risk") setCellStyle(sheetTitle[[1,1]], csSheetTitle) # ... and subtitle rows <- createRow(sheet,rowIndex=2) sheetSubTitle <- createCell(rows,colIndex=1) setCellValue(sheetSubTitle[[1,1]], "Since Inception") setCellStyle(sheetSubTitle[[1,1]], csSheetSubTitle) ### Add a chart to a different sheet # --- Slide 6 --- # Construct the chart as a dib, emf, jpeg, pict, png, or wmf file. require(gplots) skewedG2R20 = c(colorpanel(16, "darkgreen","yellow"), colorpanel(5, "yellow", "darkred")[-1]) png(filename = "corr.jpeg", width = 6, height = 8, units = "in", pointsize=12, res=120) require(PApages) page.CorHeatmap(x.R[,x.commodities], Colv=TRUE, breaks = seq(-1,1,by=.1), symkey=TRUE, col=skewedG2R20, tracecol="darkblue", cexRow=0.9, cexCol=0.9) dev.off() # --- Slide 7 --- # Create a sheet in that workbook to contain the graph sheet <- createSheet(outwb, sheetName = "Correlation Chart") # Create the Sheet title and subtitle rows <- createRow(sheet,rowIndex=1) sheetTitle <- createCell(rows, colIndex=1) setCellValue(sheetTitle[[1,1]], "Correlations Among Commodities") setCellStyle(sheetTitle[[1,1]], csSheetTitle) rows <- createRow(sheet,rowIndex=2) sheetSubTitle <- createCell(rows,colIndex=1) setCellValue(sheetSubTitle[[1,1]], "Correlations of daily returns since inception") setCellStyle(sheetSubTitle[[1,1]], csSheetSubTitle) # Add the file created previously addPicture("corr.jpeg", sheet, scale = 1, startRow = 4, startColumn = 1) # --- Slide 8 --- # Save the workbook to a file... saveWorkbook(outwb, "DJUBS Commodities Performance Summary.xlsx") # --- Slides 9, 10 --- # Show screen captures of the resulting workbook

R-bloggers.com offers daily e-mail updates about R news and tutorials about learning R and many other topics. Click here if you're looking to post or find an R/data-science job.

Want to share your content on R-bloggers? click here if you have a blog, or here if you don't.