Iterative OLS Regression Using Gauss-Seidel

Want to share your content on R-bloggers? click here if you have a blog, or here if you don't.

I just finished covering a few numerical techniques for solving systems of equations, which can be applied to find best-fit lines through a give set of data points.

The four points are arranged into an inconsistent system of four equations and two unknowns:

The system can be represented in matrix form:

The least-squares solution vector can be found by solving the normal equations

Solving for and

yields the following matrix system:

The system can be solved using Gauss-Seidel method.

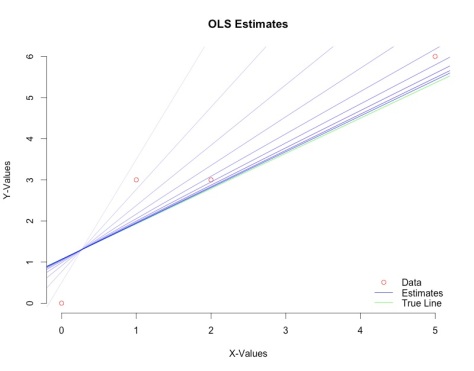

Below, I run 10 iterations of Gauss-Seidel (visualized in the figure above). The estimated line gets successively closer to the true solution in green. The estimates are shown in blue – each iteration is shown in a darker shade than the next (see highlighted lines).

library(MASS) # package needed for ginv() function

A=cbind(c(4,8),c(8,30)) # coefficient matrix

b<-t(t(c(12,39))) # b-vector

x0<-t(t(c(0,0))) # starting vector

iter<-10 # number of Gauss-Seidel iterations to run

L<-lower.tri(A)*A # lower triang. A

U<-upper.tri(A)*A # upper triang. A

D<-diag(diag(A)) # diag of A

# plot points

xc<-c(0,1,2,5)

yc<-c(0,3,3,6)

plot(xc,yc,

col='red',

xlab="X-Values",

ylab="Y-Values",

bty='n')

title(main="OLS Estimates")

legend("bottomright",

c("Data","Estimates","True Line"),

lty=c(0,1,1),

pch=c(1,NA,NA),

col=c("red","blue","green"),

bty='n')

# create color palette - lines will get darker with each iter

pal<-colorRampPalette(c("#f2f2f2", "Blue"))

colors<-pal(iter) # creates color palette of length(iter)

# plot true line

abline(a=1.0714,b=.8571,col='green')

n<-1

while(n<=iter){

print(x0)

# Gauss-Seidel formula

x1<-(ginv((L+D)))%*%((-U%*%x0)+b)

x0<-x1

n=n+1

# plot estimated line

abline(a=as.numeric(x0[2,1]), # slope of estimated line

b=as.numeric(x0[1,1]), # y-intercept of estimated line

col=colors[n]) # pick nth color in palette

}

R-bloggers.com offers daily e-mail updates about R news and tutorials about learning R and many other topics. Click here if you're looking to post or find an R/data-science job.

Want to share your content on R-bloggers? click here if you have a blog, or here if you don't.