Right Now It’s KDA…Asset Allocation.

Want to share your content on R-bloggers? click here if you have a blog, or here if you don't.

This post will introduce KDA Asset Allocation. KDA — I.E. Kipnis Defensive Adaptive Asset Allocation is a combination of Wouter Keller’s and TrendXplorer’s Defensive Asset Allocation, along with ReSolve Asset Management’s Adaptive Asset Allocation. This is an asset allocation strategy with a profile unlike most tactical asset allocation strategies I’ve seen before (namely, it barely loses any money in 2015, which was generally a brutal year for tactical asset allocation strategies).

So, the idea for this strategy came from reading an excellent post from TrendXplorer on the idea of a canary universe–using a pair of assets to determine when to increase exposure to risky/aggressive assets, and when to stay in cash. Rather than gauge it on the momentum of the universe itself, the paper by Wouter Keller and TrendXplorer instead uses proxy assets VWO and BND as a proxy universe. Furthermore, in which situations say to take full exposure to risky assets, the latest iteration of DAA actually recommends leveraging exposure to risky assets, which will also be demonstrated. Furthermore, I also applied the idea of the 1-3-6-12 fast filter espoused by Wouter Keller and TrendXplorer–namely, the sum of the 12 * 1-month momentum, 4 * 3-month momentum, 2 * 6-month momentum, and the 12 month momentum (that is, month * some number = 12). This puts a large emphasis on the front month of returns, both for the risk on/off assets, and the invested assets themselves.

However, rather than adopt the universe of investments from the TrendXplorer post, I decided to instead defer to the well-thought-out universe construction from Adaptive Asset Allocation, along with their idea to use a mean variance optimization approach for actually weighting the selected assets.

So, here are the rules:

Take the investment universe–SPY, VGK, EWJ, EEM, VNQ, RWX, IEF, TLT, DBC, GLD, and compute the 1-3-6-12 momentum filter for them (that is, the sum of 12 * 1-month momentum, 4 * 3-month momentum, 2* 6-month momentum and 12 month momentum), and rank them. The selected assets are those with a momentum above zero, and that are in the top 5.

Use a basic quadratic optimization algorithm on them, feeding in equal returns (as they passed the dual momentum filter), such as the portfolio.optim function from the tseries package.

From adaptive asset allocation, the covariance matrix is computed using one-month volatility estimates, and a correlation matrix that is the weighted average of the same parameters used for the momentum filter (that is, 12 * 1-month correlation + 4 * 3-month correlation + 2 * 6-month correlation + 12-month correlation, all divided by 19).

Next, compute your exposure to risky assets by which percentage of the two canary assets–VWO and BND–have a positive 1-3-6-12 momentum. If both assets have a positive momentum, leverage the portfolio (if desired). Reapply this algorithm every month.

All of the allocation not made to risky assets goes towards IEF (which is in the pool of risky assets as well, so some months may have a large IEF allocation) if it has a positive 1-3-6-12 momentum, or just stay in cash if it does not.

The one somewhat optimistic assumption made is that the strategy observes the close on a day, and enters at the close as well. Given a holding period of a month, this should not have a massive material impact as compared to a strategy which turns over potentially every day.

Here’s the R code to do this:

# KDA asset allocation

# KDA stands for Kipnis Defensive Adaptive (Asset Allocation).

# compute strategy statistics

stratStats <- function(rets) {

stats <- rbind(table.AnnualizedReturns(rets), maxDrawdown(rets))

stats[5,] <- stats[1,]/stats[4,]

stats[6,] <- stats[1,]/UlcerIndex(rets)

rownames(stats)[4] <- "Worst Drawdown"

rownames(stats)[5] <- "Calmar Ratio"

rownames(stats)[6] <- "Ulcer Performance Index"

return(stats)

}

# required libraries

require(quantmod)

require(PerformanceAnalytics)

require(tseries)

# symbols

symbols <- c("SPY", "VGK", "EWJ", "EEM", "VNQ", "RWX", "IEF", "TLT", "DBC", "GLD", "VWO", "BND")

# get data

rets <- list()

for(i in 1:length(symbols)) {

returns <- Return.calculate(Quandl(paste0("EOD/", symbols[i]), start_date="1990-12-31", type = "xts")$Adj_Close)

colnames(returns) <- symbols[i]

rets[[i]] <- returns

}

rets <- na.omit(do.call(cbind, rets))

# algorithm

KDA <- function(rets, offset = 0, leverageFactor = 1.5) {

# get monthly endpoints, allow for offsetting ala AllocateSmartly/Newfound Research

ep <- endpoints(rets) + offset

ep[ep < 1] <- 1

ep[ep > nrow(rets)] <- nrow(rets)

ep <- unique(ep)

# initialize vector holding zeroes for assets

emptyVec <- data.frame(t(rep(0, 10)))

colnames(emptyVec) <- symbols[1:10]

allWts <- list()

# we will use the 13612F filter

for(i in 1:(length(ep)-12)) {

# 12 assets for returns -- 2 of which are our crash protection assets

retSubset <- rets[c((ep[i]+1):ep[(i+12)]),]

epSub <- endpoints(retSubset)

sixMonths <- retSubset[(epSub[7]+1):epSub[13],]

threeMonths <- retSubset[(epSub[10]+1):epSub[13],]

oneMonth <- retSubset[(epSub[12]+1):epSub[13],]

# computer 13612 fast momentum

moms <- Return.cumulative(oneMonth) * 12 + Return.cumulative(threeMonths) * 4 +

Return.cumulative(sixMonths) * 2 + Return.cumulative(retSubset)

assetMoms <- moms[,1:10] # Adaptive Asset Allocation investable universe

cpMoms <- moms[,11:12] # VWO and BND from Defensive Asset Allocation

# find qualifying assets

highRankAssets <- rank(assetMoms) >= 6 # top 5 assets

posReturnAssets <- assetMoms > 0 # positive momentum assets

selectedAssets <- highRankAssets & posReturnAssets # intersection of the above

# perform mean-variance/quadratic optimization

investedAssets <- emptyVec

if(sum(selectedAssets)==0) {

investedAssets <- emptyVec

} else if(sum(selectedAssets)==1) {

investedAssets <- emptyVec + selectedAssets

} else {

idx <- which(selectedAssets)

# use 1-3-6-12 fast correlation average to match with momentum filter

cors <- (cor(oneMonth[,idx]) * 12 + cor(threeMonths[,idx]) * 4 +

cor(sixMonths[,idx]) * 2 + cor(retSubset[,idx]))/19

vols <- StdDev(oneMonth[,idx]) # use last month of data for volatility computation from AAA

covs <- t(vols) %*% vols * cors

# do standard min vol optimization

minVolRets <- t(matrix(rep(1, sum(selectedAssets))))

minVolWt <- portfolio.optim(x=minVolRets, covmat = covs)$pw

names(minVolWt) <- colnames(covs)

investedAssets <- emptyVec

investedAssets[,selectedAssets] <- minVolWt

}

# crash protection -- between aggressive allocation and crash protection allocation

pctAggressive <- mean(cpMoms > 0)

investedAssets <- investedAssets * pctAggressive

pctCp <- 1-pctAggressive

if(pctCp == 0) {}

# if IEF momentum is positive, invest all crash protection allocation into it

# otherwise stay in cash for crash allocation

if(assetMoms["IEF"] > 0) {

investedAssets["IEF"] <- investedAssets["IEF"] + pctCp

}

# leverage portfolio if desired in cases when both risk indicator assets have positive momentum

if(pctAggressive == 1) {

investedAssets = investedAssets * leverageFactor

}

# append to list of monthly allocations

wts <- xts(investedAssets, order.by=last(index(retSubset)))

allWts[[i]] <- wts

}

# put all weights together and compute cash allocation

allWts <- do.call(rbind, allWts)

allWts$CASH <- 1-rowSums(allWts)

# add cash returns to universe of investments

investedRets <- rets[,1:10]

investedRets$CASH <- 0

# compute portfolio returns

out <- Return.portfolio(R = investedRets, weights = allWts)

return(out)

}

# different leverages

KDA_100 <- KDA(rets, leverageFactor = 1)

KDA_150 <- KDA(rets, leverageFactor = 1.5)

KDA_200 <- KDA(rets, leverageFactor = 2)

# compare

compare <- na.omit(cbind(KDA_100, KDA_150, KDA_200))

colnames(compare) <- c("KDA_base", "KDA_lev_150%", "KDA_lev_200%")

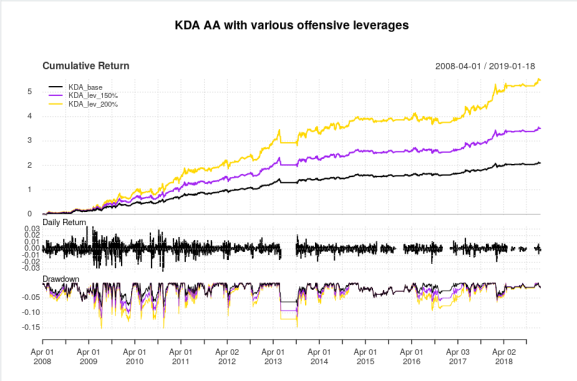

charts.PerformanceSummary(compare, colorset = c('black', 'purple', 'gold'),

main = "KDA AA with various offensive leverages")

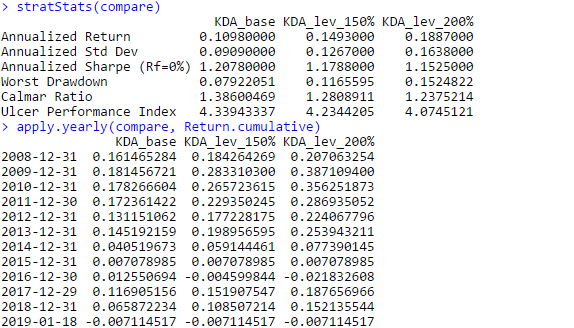

And here are the equity curves and statistics:

What appeals to me about this strategy, is that unlike most tactical asset allocation strategies, this strategy comes out relatively unscathed by the 2015-2016 whipsaws that hurt so many other tactical asset allocation strategies. However this strategy isn’t completely flawless, as sometimes, it decides that it’d be a great time to enter full risk-on mode and hit a drawdown, as evidenced by the drawdown curve. Nevertheless, the Calmar ratios are fairly solid for a tactical asset allocation rotation strategy, and even in a brutal 2018 that decimated all risk assets, this strategy managed to post a very noticeable *positive* return. On the downside, the leverage plan actually seems to *negatively* affect risk/reward characteristics in this strategy–that is, as leverage during aggressive allocations increases, characteristics such as the Sharpe and Calmar ratio actually *decrease*.

Overall, I think there are different aspects to unpack here–such as performances of risky assets as a function of the two canary universe assets, and a more optimal leverage plan. This was just the first attempt at combining two excellent ideas and seeing where the performance goes. I also hope that this strategy can have a longer backtest over at AllocateSmartly.

Thanks for reading.

R-bloggers.com offers daily e-mail updates about R news and tutorials about learning R and many other topics. Click here if you're looking to post or find an R/data-science job.

Want to share your content on R-bloggers? click here if you have a blog, or here if you don't.