Adjusted Momentum

[This article was first published on Systematic Investor » R, and kindly contributed to R-bloggers]. (You can report issue about the content on this page here)

Want to share your content on R-bloggers? click here if you have a blog, or here if you don't.

Want to share your content on R-bloggers? click here if you have a blog, or here if you don't.

David Varadi has published two excellent posts / ideas about cooking with momentum:

I just could not resist the urge to share these ideas with you. Following is implementation using the Systematic Investor Toolbox.

###############################################################################

# Load Systematic Investor Toolbox (SIT)

# http://systematicinvestor.wordpress.com/systematic-investor-toolbox/

###############################################################################

setInternet2(TRUE)

con = gzcon(url('http://www.systematicportfolio.com/sit.gz', 'rb'))

source(con)

close(con)

#*****************************************************************

# Load historical data

#******************************************************************

load.packages('quantmod')

tickers = spl('SPY,^VIX')

data <- new.env()

getSymbols(tickers, src = 'yahoo', from = '1980-01-01', env = data, auto.assign = T)

for(i in data$symbolnames) data[[i]] = adjustOHLC(data[[i]], use.Adjusted=T)

bt.prep(data, align='remove.na', fill.gaps = T)

VIX = Cl(data$VIX)

bt.prep.remove.symbols(data, 'VIX')

#*****************************************************************

# Setup

#*****************************************************************

prices = data$prices

models = list()

#*****************************************************************

# 200 SMA

#******************************************************************

data$weight[] = NA

data$weight[] = iif(prices > SMA(prices, 200), 1, 0)

models$ma200 = bt.run.share(data, clean.signal=T)

#*****************************************************************

# 200 ROC

#******************************************************************

roc = prices / mlag(prices) - 1

data$weight[] = NA

data$weight[] = iif(SMA(roc, 200) > 0, 1, 0)

models$roc200 = bt.run.share(data, clean.signal=T)

#*****************************************************************

# 200 VIX MOM

#******************************************************************

data$weight[] = NA

data$weight[] = iif(SMA(roc/VIX, 200) > 0, 1, 0)

models$vix.mom = bt.run.share(data, clean.signal=T)

#*****************************************************************

# 200 ER MOM

#******************************************************************

forecast = SMA(roc,10)

error = roc - mlag(forecast)

mae = SMA(abs(error), 10)

data$weight[] = NA

data$weight[] = iif(SMA(roc/mae, 200) > 0, 1, 0)

models$er.mom = bt.run.share(data, clean.signal=T)

#*****************************************************************

# Report

#******************************************************************

strategy.performance.snapshoot(models, T)

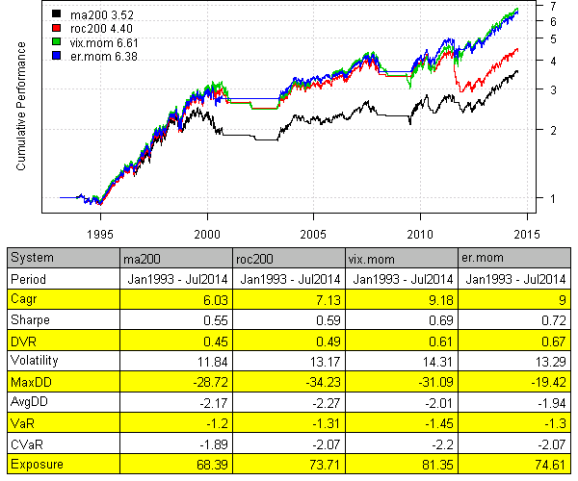

Please enjoy and share your ideas with David and myself.

To view the complete source code for this example, please have a look at the

bt.adjusted.momentum.test() function in bt.test.r at github.

To leave a comment for the author, please follow the link and comment on their blog: Systematic Investor » R.

R-bloggers.com offers daily e-mail updates about R news and tutorials about learning R and many other topics. Click here if you're looking to post or find an R/data-science job.

Want to share your content on R-bloggers? click here if you have a blog, or here if you don't.