Update for Backtesting Asset Allocation Portfolios post

Want to share your content on R-bloggers? click here if you have a blog, or here if you don't.

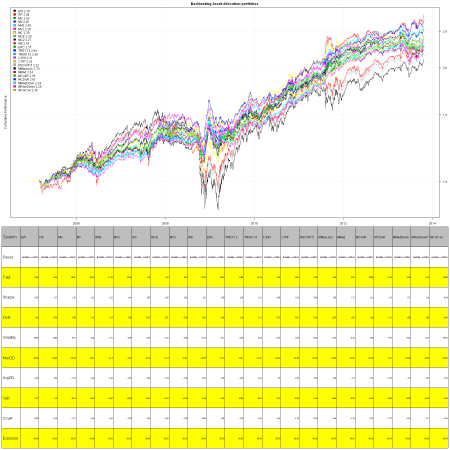

It was over a year since my original post, Backtesting Asset Allocation portfolios. I have expanded the functionality of the Systematic Investor Toolbox both in terms of optimization functions and helper back-test functions during this period.

Today, I want to update the Backtesting Asset Allocation portfolios post and showcase new functionality. I will use the following global asset universe as: SPY,QQQ,EEM,IWM,EFA,TLT,IYR,GLD to form portfolios every month using different asset allocation methods.

###############################################################################

# Load Systematic Investor Toolbox (SIT)

# http://systematicinvestor.wordpress.com/systematic-investor-toolbox/

###############################################################################

setInternet2(TRUE)

con = gzcon(url('http://www.systematicportfolio.com/sit.gz', 'rb'))

source(con)

close(con)

#*****************************************************************

# Load historical data

#******************************************************************

load.packages('quantmod,quadprog,corpcor,lpSolve')

tickers = spl('SPY,QQQ,EEM,IWM,EFA,TLT,IYR,GLD')

data <- new.env()

getSymbols(tickers, src = 'yahoo', from = '1980-01-01', env = data, auto.assign = T)

for(i in ls(data)) data[[i]] = adjustOHLC(data[[i]], use.Adjusted=T)

bt.prep(data, align='remove.na', dates='1990::')

#*****************************************************************

# Code Strategies

#******************************************************************

cluster.group = cluster.group.kmeans.90

obj = portfolio.allocation.helper(data$prices,

periodicity = 'months', lookback.len = 60,

min.risk.fns = list(

EW=equal.weight.portfolio,

RP=risk.parity.portfolio,

MD=max.div.portfolio,

MV=min.var.portfolio,

MVE=min.var.excel.portfolio,

MV2=min.var2.portfolio,

MC=min.corr.portfolio,

MCE=min.corr.excel.portfolio,

MC2=min.corr2.portfolio,

MS=max.sharpe.portfolio(),

ERC = equal.risk.contribution.portfolio,

# target retunr / risk

TRET.12 = target.return.portfolio(12/100),

TRISK.10 = target.risk.portfolio(10/100),

# cluster

C.EW = distribute.weights(equal.weight.portfolio, cluster.group),

C.RP = distribute.weights(risk.parity.portfolio, cluster.group),

# rso

RSO.RP.5 = rso.portfolio(risk.parity.portfolio, 5, 500),

# others

MMaxLoss = min.maxloss.portfolio,

MMad = min.mad.portfolio,

MCVaR = min.cvar.portfolio,

MCDaR = min.cdar.portfolio,

MMadDown = min.mad.downside.portfolio,

MRiskDown = min.risk.downside.portfolio,

MCorCov = min.cor.insteadof.cov.portfolio

)

)

models = create.strategies(obj, data)$models

#*****************************************************************

# Create Report

#******************************************************************

strategy.performance.snapshoot(models, T, 'Backtesting Asset Allocation portfolios')

I hope you will enjoy creating your own portfolio allocation methods or playing with a large variety of portfolio allocation techniques that are readily available for your experimentation.

To view the complete source code for this example, please have a look at the bt.aa.test.new() function in bt.test.r at github.

R-bloggers.com offers daily e-mail updates about R news and tutorials about learning R and many other topics. Click here if you're looking to post or find an R/data-science job.

Want to share your content on R-bloggers? click here if you have a blog, or here if you don't.