Update: Extending Commodity time series

[This article was first published on Systematic Investor » R, and kindly contributed to R-bloggers]. (You can report issue about the content on this page here)

Want to share your content on R-bloggers? click here if you have a blog, or here if you don't.

Want to share your content on R-bloggers? click here if you have a blog, or here if you don't.

I showed an example of Extending Commodity time series back in 2012. Since then, the web site that I used to get the Thomson Reuters/Jefferies CRB Index data is no longer working. But there are a few alternatives:

- Thomson Reuters / Jefferies CRB Index.

To get data, first select “TRJ/CRB Index-Total Return”, next click “See Chart”. There will be “Download to Spreadsheet” link beneath the chart. - TR/J CRB Global Commodity Equity Index

To get data, first select “TR/J CRB Global Commodity Equity Index”, “Total Return”, check “All Dates”, next click “OK” to download the data.

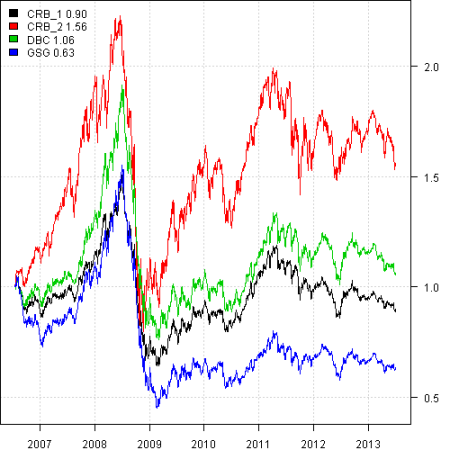

There is a difference between these two series. I did not found a reason for the discrepancy, but truthfully, I did not look very hard. So I welcome any insights or feedback.

The Thomson Reuters / Jefferies CRB Index time series is better fit for the DBC and GSG etfs.

Now let’s plot the CRB index alternatives and DBC and GSG Commodity ETFs side by side to visual check the similarity.

###############################################################################

# Load Systematic Investor Toolbox (SIT)

# http://systematicinvestor.wordpress.com/systematic-investor-toolbox/

###############################################################################

setInternet2(TRUE)

con = gzcon(url('http://www.systematicportfolio.com/sit.gz', 'rb'))

source(con)

close(con)

#*****************************************************************

# Load historical data

#******************************************************************

load.packages('quantmod')

tickers = spl('GSG,DBC')

data = new.env()

getSymbols(tickers, src = 'yahoo', from = '1970-01-01', env = data, auto.assign = T)

for(i in ls(data)) data[[i]] = adjustOHLC(data[[i]], use.Adjusted=T)

# "TRJ_CRB" file was downloaded from the http://www.jefferies.com/Commodities/2cc/389

# for "TRJ/CRB Index-Total Return"

temp = extract.table.from.webpage( join(readLines("TRJ_CRB")), 'EODValue' )

temp = join( apply(temp, 1, join, ','), '\n' )

data$CRB_1 = make.stock.xts( read.xts(temp, format='%m/%d/%y' ) )

# "prfmdata.csv" file was downloaded from the http://www.crbequityindexes.com/indexdata-form.php

# for "TR/J CRB Global Commodity Equity Index", "Total Return", "All Dates"

data$CRB_2 = make.stock.xts( read.xts("prfmdata.csv", format='%m/%d/%Y' ) )

bt.prep(data, align='remove.na')

#*****************************************************************

# Compare

#******************************************************************

plota.matplot(scale.one(data$prices))

To leave a comment for the author, please follow the link and comment on their blog: Systematic Investor » R.

R-bloggers.com offers daily e-mail updates about R news and tutorials about learning R and many other topics. Click here if you're looking to post or find an R/data-science job.

Want to share your content on R-bloggers? click here if you have a blog, or here if you don't.